Global payment revenues are now worth an estimated $2.2 trillion, having grown 11 percent last year, with no signs of this double-digit growth slowing. Consequently, investment in payments innovation has reached an all-time high, as global businesses and financial institutions look to take a greater slice of the pie.

Payment innovations continue to revolutionise the industry, offering greater flexibility to customers and opportunities for big corporates and financial institutions to develop compelling and winning propositions, whilst also reducing cost. New products, technologies, partnerships and ways of managing payments are being introduced rapidly, arguably at a pace never seen before.

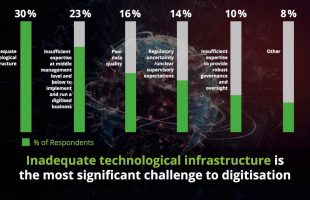

However, what is clear is that the industry isn’t aligned on which innovations to invest in, nor the regulators role in creating an innovative ecosystem. What is an absolute necessity versus a nice to have? What foundations do you need to take advantage of innovations? And which innovations will drive bottom line growth? These challenges are further complicated by the need for cross-industry collaboration to successfully realise the benefits of many innovations in the market today. When speaking to our clients about their investment plans for payment innovation, we frequently hear the same message, there is simply too much happening at once to have a single threaded roadmap.

A lot of payment portfolio change is in response to regulatory driven initiatives, such as NPA in the UK, FedNow in the US, a mooted PSD3 in Europe or the introduction of ISO20022 standards globally. All of which have material costs to meet, leaving little room for nice to haves or pet projects. The larger financial institutions have concerns about being disintermediated due to disruptors and innovators across the end-to-end payments value chain whilst they are preparing and pre-occupied with meeting regulatory standards.

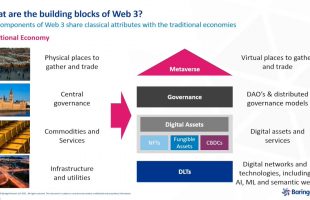

So what innovations do we see in the market? The push for real time payments, improvements to settlement from new central infrastructure players such as regulated liability network, embedded and open finance, tokenisation, request to pay, variable recurring payments, intelligence, wholesale and retail CBDCs, and there are many more. Given the volume of changes, those owning payments innovation portfolios are having to ask themselves where their organisation should invest their time and money and where are the genuinely differentiating opportunities vs. simple hygiene plays.

Our role is to help our clients to ask the right questions regarding payments innovations and to come up with the answers that are specific and right for their strategic drivers. We help our clients to cut through this noise. At Baringa our payments experts live and breathe payments and know what it takes to execute sustainable change. We work with you, to take pragmatic and realistic decisions around payment innovations to help you to develop and deliver payments roadmaps that are right for you.

Learn more: https://www.baringa.com/en/insights/future-proofing-payments/