Mark Bower-Easton of Oxford Capital explains all about Enterprise Investment Scheme (EIS) investing. This type of investing has to be classified as high risk but as one would expect greater risk can offer greater reward. Mark discusses the firm’s investment approach and he is pleased to share with us the firm’s excellent track record and the sort of returns their clients have enjoyed. This interview will appeal to business owners, higher earners who are already making the most of all their tax allowances and professional advisers looking after such clients.

Introduction by Marc Harris

Ch 1. What are Enterprise Investment Schemes?

Ch 2. Who Mark, is attracted to investing in EIS?

Ch 3. You mentioned extracting cash out of the business, how does that work?

Ch 4. Can you tell us about the various tax advantages please?

Ch 5. And could you please also explain the loss relief?

Ch 6. For the right type of investor this is very attractive

Ch 7. How much can someone invest in EIS?

Ch 8. Could you tell us more about Oxford Capital and the firm’s investment ethos?

Ch 9. Would Oxford Capital be the only invester in a qualifying company?

Ch 10. Please talk us through your managed portfolio option?

Ch 11. How many clients do you have?

Ch 12. For more sophisticated, or hands-on investors you offer something called the co -investor circle?

Ch 13. Are you able to give us an idea of how an individuals’ portfolio might have perfomed over the last five or the last 10 years?

Ch 14. Is the next few years only going to see more businesses coming onto your radar?

EIS To Tax-Efficiently Extract Profits From Your Business

** The text within this document has been auto-generated from the original recording and therefore may contain small inaccuracies.

Marc Harris

You’re watching Business TV. Thanks so much for joining us again. In the interview you’re about to watch, I chatted with Mark Bower-Easton of investment firm Oxford Capital. Oxford Capital pioneered investing in early stage groundbreaking companies who qualified for the government’s enterprise investment scheme.

So for some 20 years now, the firm have provided private investors with access to some of the very powerful returns that can be had by investing in some of the UK’s most innovative companies operating in high growth sectors such as e commerce, fintech, digital health, and of course, these days, artificial intelligence.

Mark has over 20 years experience working in financial services, having qualified as financial advisor, and then later as a stockbroker. Back in the early 2000s, he then spent the best part of a decade working as a partner for one of the UK’s leading wealth management firms.

And in his current role at Oxford Capital, Mark looks after product development, he looks after many of the firm’s key investor clients. And he also sits on the firm’s investment committee.

One of the reasons we’re talking right now is that in the recent budget, the government extended, albeit predictably, the tax breaks associated with enterprise investment scheme investing for another 10 years or a little bit more than 10 years up until 2035. But can you just give us a quick walkthrough as to what enterprise investment schemes are and you know what they’re all about and why they exist and how long they’ve been around?

Mark Bower-Easton:

Yeah, sure. So the enterprise investment scheme was something that was launched by the conservative government back in 1994.

And it was a way to incentivize investors to invest in early stage businesses in the UK, who historically struggled to raise equity because of the risks involved. So EIS was created to incentivize people to invest into those businesses, which are still high risk, but you do get some very attractive tax advantages for investing in those businesses.

The reason why the government wanted to do it was because if you are creating new businesses, you’re helping the economy, you’re helping the jobs market. So since 1994, 53 ,000 companies have been created using EIS, and over £30 billion has been raised using Enterprise Investment Scheme.

Marc Harris:

Fair to say, based on those numbers, that it’s been a huge success so far.

Mark Bower-Easton:

Yeah, absolutely. There are a lot of companies that are household names now that the grassroots of their growth cycle was helped by Enterprise Investment Scheme.

Marc Harris:

Who Mark, is attracted to investing in EIS?

Mark Bower-Easton:

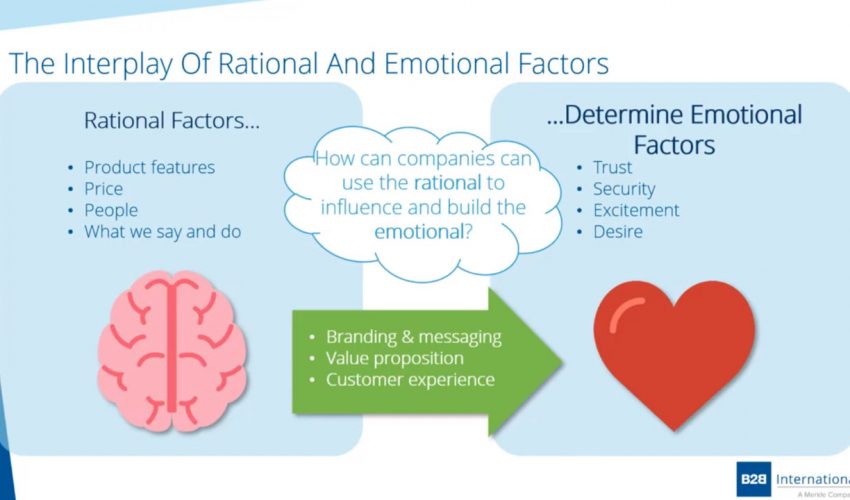

So we actually have investors from all walks of life. As we spoke about previously, if you’ve got the correct attitude to risk and the other components to the decision -making process, it gives the right investor access to companies that aren’t available anywhere else in the market.

And it’s actually a really compelling tax planning tool as well. Our investors are varied from professionals who are looking to save income tax from their salary or from their bonuses, from property developers looking to sell down some of their properties and to perhaps defer their CGT liability.

We have business owners who are looking to extract capital or profits from their business in the most tax efficient way possible. And we also have family offices who are looking to diversify their holdings and also save some tax at the same time.

Marc Harris:

All of the above certainly fit into the business TV audience but the overwhelming majority of our viewers are your typical owner -directors of mid -sized companies. So you mentioned extracting cash out of the business. That’s always a challenge. So exactly how does that work? Because that will certainly be of interest to most of our viewers.

Mark Bower-Easton:

Yeah, sure. So if you’re a business owner, you typically have retained profits in your business and if you want to extract those profits you either pay them out as an income and typically you will pay 45% tax or you’ll pay them out as a dividend which is the most popular way where the tax rate is more like I think 39 .2%, something like that.

With EIS, the income tax relief, it doesn’t distinguish between earned income and dividend income. So if you are a business owner, you can extract that cash, pay it out to you as a dividend. In theory, you would pay the 39% tax, but then you could claim the 30% income tax relief from the EIS to essentially give you a tax, a tax ban of 9%.

Marc Harris:

Right, and that can be achieved year on year, of course.

Mark Bower-Easton:

Yes, absolutely, absolutely. And we have a, you know, we have a large number of business owners who do this on an annual basis.

Marc Harris:

Let’s look at those tax advantages then. There’s a number, aren’t there? So perhaps you could just sort of walk us through them and maybe when we can, let’s think about using maybe £100 ,000 as an investment figure to give us a round number to sort of see how those tax incentives might actually work for the individual.

Mark Bower-Easton:

Yeah, absolutely. Absolutely. So there’s a multitude of tax reliefs associated with EIS and there’s a variety of ways that investors and financial advisors can use it to help plan an investor or a client’s financial circumstances.

I guess the headline tax relief that most people who are broadly familiar with EIS know about is the 30% income tax relief that you get upfront. So using the £100 ,000 example, if someone invests £100 ,000 into an EIS product, they will get £30 ,000 income tax relief bank.

So this means that if someone is earning, let’s say £100 ,000 a year, broadly speaking, they’re going to have a tax bill of about £29 ,000 a year. Using EIS, if they invest £100 ,000, they would be able to wipe out that income tax bill in its entirety.

What you can also do with the income tax benefit is to roll it back one year as well. So if someone earns £100 ,000 and they perhaps don’t want to write off £30 ,000 in this tax year, you could potentially write off £10 ,000 or £15 ,000 in the current tax year and roll the remainder back one previous tax year.

If you’ve got a tax liability in that year as well. The way it works is that each company in an EIS portfolio gets its own EIS3 certificate. And when you get that certificate, there will be a monetary amount that you can offset.

And then that goes either when your tax return or you send it to your local tax office. And that’s how you get the tax back. Unfortunately, it’s not quite as simple as investing £100 ,000 and immediately getting the £30 ,000 back.

It’s dependent on how slowly or how quickly the cash is deployed into these underlines. companies. There’s just one caveat to this and that’s that as long as the shares are held for a minimum of three years the income tax 30% benefit will be retained.

If the shares are sold within three years then HMRC will be well within their rights to call back that income tax relief. So it’s really important for us when we’re investing that we’re making sure that companies that we invest into are looking to grow over at least five to seven years not trying to get some money and get out as quickly as possible.

Marc Harris:

That income tax relief then bar a couple of caveats that you explain there maybe we’ll talk a little bit more about those later. That’s extremely generous you’ve also got capital gains tax I think.

Mark Bower-Easton:

Yeah so any gains that are generated through EIS are free from capital gains tax again. as long as the shares are held for at least three years. There’s also something called capital gains tax deferral relief, which is very popular with our investors at the moment. Potentially, there might be some people watching this who have had a really good run in traditional equity markets and they’re sitting on a big capital gain on their share portfolio, or they’ve got a portfolio of properties and they perhaps don’t really like the direction of the property markets going in.

So they want to crystallize some of those gains that they’ve made rather than paying CGT of 20% or 28% for property. One thing you can do with EIS is invest the gain element into an EIS and that will indefinitely defer the capital gains payment.

Marc Harris:

And indefinitely defer the-

Mark Bower-Easton:

Indefinitely defer it, yes. So if you reinvest the gain into an EIS, you defer that capital gain. If you sell, if we sell the EIS qualifying shares, all you have to do is roll over that value into a new EIS scheme and you continue to defer CGT.

One of the great planning strategies with this is for in particular, maybe slightly older investors who have a CGT liability and they also have an inheritance tax liability. CGT, capital gains tax, is the only tax that dies with you.

So if you’re sitting on a big capital gain, your beneficiaries, they won’t have to pay the CGT liability upon inheriting the assets, but it doesn’t solve the inheritance tax issue. So if you’re sitting on a capital gain of a million pounds, let’s say, you won’t have to pay the CGT, but that asset will- clobbered with a 40% inheritance tax charge.

With EIS, it takes care of the CGT liability and also the inheritance tax liability because the underlying shares qualify for business relief, which means after a two -year holding period, the share value falls outside of your estate for inheritance tax purposes.

Marc Harris:

So when your estate is passed on then, the beneficiary is is benefiting from all of those tax breaks because those shares have already been held for two years. The idea of having to hold those shares for a period of two years is not about the individual investor’s period of time with those shares, it’s about the investment in that company. So it doesn’t begin again once the shares are passed on to the beneficiary.

Mark Bower-Easton:

Correct.

Marc Harris:

Let’s also just quickly touch upon, if I may, the loss release because you mentioned at the beginning of course the reason that these incentives are in place because it is considered a high -risk investment.

in reality, although one wants to avoid this, but there can be companies that don’t do well, but there’s also loss relief, isn’t there? So can you just sort of explain to us how the loss relief works?

Mark Bower-Easton:

Loss relief, I think, I think EIS is probably one of the only types of investment where you get a degree of downside protection that’s offered by the government. And the way loss relief works is it’s based on the individual companies in the portfolio, not the portfolio overall.

So to give you an example, if you have an, you know, if you invest 100 ,000 pounds into EIS and let’s say gross to 200 ,000 pounds, but there are two companies in your portfolio that failed, you can still claim loss relief, even though your overall situation is very, very positive.

As we’ve mentioned previously, you know, EIS venture capital investing is high risk. And if you’re creating a portfolio of 10 to 12 companies, then in all likelihood, three or four of those companies are going to fail.

Loss relief gives you an element of downside protection. And what it means is that the government allow you to offset that loss against a future income tax bill or a capital gains tax liability. So the results of it, once it’s all worked out, is that if there is a total loss of a portfolio company, if you’re an additional rate taxpayer, the most you can lose is 38 .5% of your money.

If you’re a higher rate taxpayer, the most you can lose is 42% of your capital. Still not a great situation, but it’s better than losing 100% of your initial capital.

Marc Harris:

And it’s interesting that that loss relief isn’t automatically offset against the gains that one might make on other areas of the portfolio. It’s 100 %… that amount of loss relief on loss making company.

Mark Bower-Easton:

Yes. It’s one of the biggest selling points of EIS for sure. You know, it is, as we speak about very often, it is super high risk. You know, the FCA, they have a banding from one to seven when it comes to risk profile of different types of investments.

EIS, venture capital investing is a six. So it’s not for everyone. You know, when we’re talking about risk as well, you know, I used to be a wealth manager myself, so I’m very familiar with talking about investment risk and ascertaining an investor’s attitude to risk.

And when you’re talking about more liquid investments, such as, you know, maybe a FTSE 100 unit trust, the key thing to work out with an investor there is, is their attitude to risk right for this product.

With EIS, with venture capital, there’s a couple of more, there’s a couple more elements you have to think about. Yes, the risk profile is really important, but you also need to talk about liquidity as well.

You’re investing in unquoted companies, so you can’t just pick up the phone and say, I’ve had a good run, I want my money back, please. In order to sell these shares, we, as the fund manager, need to find the buyer.

So if an investor thinks that they’re going to need the capital that they’ve invested within five to seven years, an EIS probably isn’t for them. If they’re investing an amount of money, and if it does go wrong, if they do lose money, if that amount of money will have a negative effect on their standard of living, then an EIS isn’t for them either.

So anyone who’s considering EIS needs to think about their tolerance to risk, their liquidity requirements, and also their capacity for loss. If there’s a flag on any of those three elements, then an EIS isn’t for them.

Marc Harris:

But conversely, if people are not falling into those brackets, then it is people who have already maxed out all of the available tax breaks that they can get. And indeed understand the sort of timeframes that you’re talking about, then it does represent a very attractive option.

Mark Bower-Easton:

Yeah, it is a very, very attractive option for the right type of investor. And we get investors from all walks of life. We have investors who are city professionals who maybe work in financial services or have legal backgrounds or accountancy backgrounds and they get their bonuses and you don’t really want to be paying a big, large sum of income tax on your bonus.

So EIS is a great way to invest a portion of your bonus. offset some of the income tax. We have property developers who are looking to alternate their, you know, expand their portfolio of assets that they hold.

We have family offices who are looking to diversify their holdings and to save some tax for the family overall. So, you know, there’s not really a specific client that looks towards EIS. It is all walks of life and it really is dependent on their tolerance to risk.

Marc Harris:

We keep using this example of a hundred thousand pounds of investments for the benefit of being able to sort of interpret round numbers as far as these tax breaks are concerned. But a hundred thousand pounds, of course, it’s not. not the maximum amount an individual client can come to you and invest in, but can you talk just through what sort of amounts of money somebody can invest into these schemes?

Mark Bower-Easton:

Yeah, sure. So our minimum investment here at Oxford Capital is £25 ,000. I think we use the £100 ,000 example because it’s just very easy to explain it. We don’t need to get too in -depth. The annual limit is actually £1 million a year. If you are a knowledge -intensive EIS, that actually doubles to £2 million a year. If you haven’t done EIS before and you really like it and you’re sitting on a big amount of cash and you’ve perhaps sold a business, for example, it’s possible to use the current tax year’s allowance and the previous tax year’s allowance.

So if it’s just a standard EIS, you could actually invest £2 million. If it’s a knowledge -intensive EIS, you could invest £4 million in this tax year. So it can go from £25 ,000 to a very, very, very significant number.

And what we’ve done at Oxford Capital for 2024 to reflect this, and also to reflect the FCA’s new consumer duty rules, is we’ve relaunched our fee structure for 2024. So we’ve introduced a tiered initial fee structure now, which recognises economies of scale, that someone investing £1 ,000 ,000 or £4 million shouldn’t be paying the same initial fee percentage as someone investing a smaller amount of money.

We’ve also reduced our annual management fees significantly. We then also introduced a cap on the annual management fees, which means that now any new investor who comes in day one knows with absolute clarity what the maximum lifetime cost of their investment is going to be and that’s a great comfort to have in these uncertain political and economical times.

We’ve also increased our performance fee hurdle as well so previously we had to return a hundred percent with investors subscription before we levied the 20% performance fee on the excess it’s now 120 percent of the investors net subscription.

Marc Harris:

The adjusting of your fee structure there certainly demonstrates that you guys are confident.

Mark Bower-Easton:

Yeah absolutely.

Marc Harris:

Just one question about that when you when you mentioned the knowledge intensive it’s obviously that’s applied to individual companies that sit within perhaps a portfolio if yeah right and that knowing whether a company is qualifying for knowledge in knowledge intensive investment of course is part of the part of the work that you perform there

Mark Bower-Easton:

Yeah exactly I mean knowledge intensive. essentially means that a company is going to be raising a significant amount of money and a significant proportion of that money is going to be used for research and development. That’s basically what knowledge intensive means.

Marc Harris:

Right, but listening to some of the areas that excite you and your team, a lot of the businesses that you’re investing in are automatically going to qualify for that knowledge.

Mark Bower-Easton:

Yes, exactly. Exactly.

Marc Harris:

So can you sort of talk us through what your investment ethos is, how you go about selecting companies out of the vast universe of companies that are out there that you perhaps could be putting clients’ money into? More about Oxford Capital and how you work, because of course that has to be key.

Mark Bower-Easton:

Yeah, sure. So Oxford Capital were founded in 1999, so we’ve been doing this for 25 years now, and we pioneered some of the earliest fund structures in the enterprise investments key market.

Before Oxford Capital came along, if you wanted to take advantage of EIS tax reliefs, you’d need to find the businesses yourself, you’d need to do your due diligence, you need to paperwork yourself, and it was a really time -consuming process.

And there were a lot of failed businesses and a lot of people lost a decent amount of money. We saw an opportunity to create a platform where we could do all of the due diligence, we could source the businesses, we could do all the paperwork, and investors, if they were happy to subscribe an amount of money to us, we would create a portfolio for them, run those companies for five to seven years, and hopefully provide them with a successful exit.

Over the last 25 years, we’ve invested in over 100 companies, we’ve raised about £450 million. In terms of where we get companies from, our deal flow comes from a variety of sources, we get probably 2 ,000 applications for funding each year, some of them come to us directly through our website. Some of us contact us on LinkedIn, some of them we get introduced by existing founders to new founders. And so when you’re looking at 2000 deals, it’s really important that you have a processing place to sift through them as quickly as possible and finding the right ones that fit in with our own investment strategy.

So out of those 2000, I’d say probably about 1800 to 1900 don’t really pass muster, either because the business idea is flawed or it doesn’t fit in with our strategy, or it’s too early stage or it’s too late stage.

Out of those maybe 100, our analysts will take a deeper dive into the business, into the financials, into the projections, and most importantly have a founder as well. We very much focus on the quality of the founder.

If we think that we can work with them, if we think that they are open to listening to our ideas, then that puts them quite high, quite far up in the queue. Those 100 businesses that we do more of a deep dive in, we probably sift down to maybe 15 to 20 each year that we take through to our investment committee.

And from there, I would say probably eight to 10 of those businesses get an investment from us. So the companies have to be very high quality. They have to be in sectors that we like, that we feel that we can add value to.

Talking about sectors, at the moment, we really like FinTech, we like digital health, we like cybersecurity, we like e -commerce platforms. If companies are doing interesting things with artificial intelligence, then that’s a big tick in our box.

A lot of investors ask me, is AI a fad? I think that there are a lot of companies jumping on the AI bandwagon at the moment. So sometimes it’s a little bit difficult to work out which ones are actually using artificial intelligence properly.

But fortunately, we’ve got some very good analysts who can kind of sort the wheat from the chaff. In terms of businesses that we look at, there’s really two types of businesses. There’s what we call early growth businesses, which are companies that are selling a product that have early indications of market fit, that they are generating revenue.

And our goal there is to build the business, increase the revenues, launch the company into new products, into new geographical locations. make them profitable and then sell. The other type of company is high potential and this is less about revenue and it’s more about the intellectual property within the business.

It’s about the size of the prize. It’s about the technology. It’s looking at the implications for that technology. How valuable is it now? How valuable can it be? And typically we work with these companies to get their technology to a point where it’s really attractive for a larger player in that sector to come and acquire the technology.

You tend to find that these big businesses in certain sectors, they don’t really create their new technology. They buy it in. When someone has a great idea, they will come and take that tech and, you know, bring it into their wider business.

A great example of this is a company that we exited a few years ago, Oxford -based university spin -out called Latent Logic. It had created an AI algorithm for self -driving cars. About three years after it was created, Google came in and said, we want that technology for Waymo, our self -car driving division.

And so they purchased the company in its entirety.

Marc Harris:

When Oxford Capital are investing in one of these businesses that you then single out and you’ve looked and done your due diligence, would you then, Mark, be the only investor in that company? Or would there be other organizations, other outfits similar to yourselves that are also investing in that company? How does that actually work?

Mark Bower-Easton:

Yeah, we prefer not to invest on our own. And so we like to co -invest alongside other institutional investors. It gives us a degree of comfort when you see some very high quality VCs on the term sheet. It enables us to spread the risk. It enables us to share due diligence with other VCs and to get a different perspective on the deal that we’re all looking at.

So very much we view it as a partnership. We’re not in competition with other VCs. We work with a lot of venture capital houses. We share deal flow. And yeah, it’s a strategy that has seen us perform pretty well over the years.

Marc Harris:

How individuals can invest with you. You’ve got a couple of ways that that actually works. One is the managed portfolio service. Can you tell us about that? And then perhaps go on to explain how the other method works as well?

Mark Bower-Easton:

Yeah, sure. So the managed… the managed way is our growth EIS portfolio which is a discretionary managed approach and that’s more of a hands -off approach where an investor will subscribe let’s say 100 ,000 pounds to us.

We will take typically 12 to 18 months to fully deploy that capital across typically 10 to 12 companies so it’s up to us to find the companies, it’s up to us to grow those companies and it’s up to us to exit those companies for our investors.

We make sure that our portfolios are diversified across different sectors, we make sure that investors are diversified across companies who are at different stages of their growth cycle as well and this is a really important de -risking strategy for us because it would be very easy to go out there and find 10 companies that we could invest into at the seed stage, put 10% into each, but that’s very high risk.

And typically when you’re at the seed stage, that’s at the point of the biggest risk of failure. So we try to do risk as much as possible by limiting exposure into seed stage companies. Out of those 10 to 12 companies, any new investor will typically find three or four seed stage companies in their portfolio where we as a business are investing for the first time.

So these seed stage companies, they have the highest potential return, but they also have the highest risk of failure and the longest investment life cycle. So the way we try to mitigate downside risk is by limiting exposure into these businesses.

So we typically deploy about 5% of an investor subscription into each one of these seed stage businesses. So around 20% of an investor’s portfolio will be in seed stage deals. The bulk of the portfolio, probably about 50% is made up of series A deals.

So these are companies where we have invested into previously. We’ve had a year to 18 months of sitting on the board, getting to know the founder, getting to know the business. And we’re in a position where we have the confidence and the conviction to invest more money into this business, a much larger check into this business.

And so we have the confidence to increase that exposure from 5% to 10%. And there will typically be maybe five companies in the portfolio that are series A.

But the rest of the portfolio will be series B, series C. So companies who are perhaps looking to do their final private funding round before an exit. Most of the downside risk will have been missing. But we still think there is significant potential upside in these businesses to make it worthwhile.

The investment horizon is much shorter, we’d be looking to exit after maybe three to four years in these businesses. And as a result, we deploy around 10 to 15% in each one of these scale up businesses. So that’s how the portfolio is created, you get the significant gains from the seed end, you get the security and solid returns from the later end. And that’s when you start getting liquidity back as well.

The later stage companies, it stands to reason that you’ll start getting the money back from these businesses before you get the money back from the seed stage businesses.

Marc Harris:

You’re there to speak with advisors or directly with them.

Mark Bower-Easton:

Yeah, absolutely. You know, we are here to speak to investors. We’re here to speak to financial advisors. We like to work in partnership. We’re not the typical investment fund in that we will take a subscription and then you’ll only hear from us a couple of times a year when valuations come around. I think when you’re investing in something high risk and something that is investing in early stage businesses, you tend to find with venture capital investing, there’s a lot of emotional attachment to the underlying businesses.

If you invest in a FTSE 100 tracker, you don’t really care about what’s going on with Shell or BP as long as they continue to pay you a dividend. With this, we tend to find that our investors really get involved with the underlying businesses and they like to hear what’s going on with these businesses.

So we always make sure that we offer every investor and advisor an opportunity to speak to us directly at least a couple of times a year to go through the portfolio to tell investors and advisors what’s going well in the portfolio, what’s going not so well and the reasons why. And that just really adds value to the relationship between us and the investors and it adds a lot of value with the relationship between us and advisors as well.

Marc Harris:

The individual client or the client and his or her advisor, they’ve got a dashboard, don’t they? A login sort of interface with yourselves where all that’s going on with their money and the portfolio that they’ve invested in, it’s all there laid out in real time in front of them in a digital format and the portfolio is valued a couple of times. Valuations against the portfolio given a couple of times a year and so there’s that sort of constant contact between you and the client, isn’t there?

Mark Bower-Easton:

Yeah, so we’ve got a very good online portal which Anyone who invests with us, they get access to the online portal. If it’s a direct client coming to us, they’re able to give their accountant a login as well if they want their accountant to do with the EIS3 certificates. If it’s a wealth manager introducing a client to us, then the wealth manager and the client gets access to the portal.

On the portal, you can see up -to -date valuations. You can see cash balances. You can download the EIS3 certificates. If there is a loss, you can download the loss relief statements as well. So yeah, we try to make it as easy as possible for investors to keep up to date with their valuations.

Marc Harris:

How many individual clients do you have as customers?

Mark Bower-Easton:

It’s a great question. been doing this for quite a while now, so we’ve got a lot of very loyal customers. We’ve probably at about 7 ,000 now. We have a lot of investors who have been with us for quite a significant period of time.

We have a lot of very loyal investors who invest tax year after tax year after tax year. We like to, because we’re an evergreen fund and we are constantly investing, a lot of our investors like to follow our investment program.

So when we are getting close to fully deploying their capital, we will send them a note to say that if you want to continue your program, you need to invest a little bit more. And typically that’s the point when they will send us some more cash and we will continue deployment for them.

Marc Harris:

More sophisticated investors or more hands -on investors, people perhaps I guess by definition probably got even larger sums of money to invest. You offer something called the co -investor circle, don’t you?

Mark Bower-Easton:

So the co -investor circle, the deal flow broadly follows the companies that we invest into through the growth EIS portfolio. But one of the reasons why we launched the co -investor circle is because we tended to find that a lot of clients who invested through the fund wanted to make follow -on investments into specific companies that made up their portfolio initially.

And so we launched the co -investor circle about 10 years ago now and it’s got about 450 members, it’s raised about 85 million pounds over this time. And what it does is enables more sophisticated investors to invest into individual company deals.

You tend to find when you’re a sophisticated investor, you might have a preferred sector that you want to invest into or you might have a preferred stage of growth that you want to invest into. So this enables more sophisticated investors to essentially create their own EIS portfolios.

Most of the companies that go through the Co -Investor Circle are EIS qualifying. However, the beauty of the Co -Investor Circle platform is that it enables us to continue investing in companies when they may have potentially outgrown EIS tax reliefs.

And that’s where family offices come in. That’s where people who perhaps non -UK start getting interested in some of our portfolio companies. Because if a company typically outgrows EIS tax reliefs, then they’re in a pretty good position.

So the downside risk is very low. There’s still some significant upside potential and the timescale. is not going to be particularly long until an exit hopefully. It also enables us to help facilitate exits from some of our existing portfolio companies because you can offer secondary shares through the co -investor circle.

Marc Harris:

I know we can’t predict the future, but are you able to give us an idea of the sort of values that an individual’s portfolio might have increased by over perhaps the last five years or the last 10 years?

Is that a fair question?

Mark Bower-Easton:

It’s a very fair question. I think when you are investing in something like this, you need to be aware of the downside risk, but you need to also be aware that the company you’re entrusting your money with is actually any good at picking businesses.

At the end of the day, we are stock pickers. We’re looking at a few sheets of paper and engaging in those initial discussions based on a pitch deck, so we need to be able to see what good looks like and we do seem to be very good at that.

Our current IRR, the percentage that our portfolio companies grows by each year, currently sits at 13 .2%, so our portfolio is growing on average 13 .2% a year. If you want to bring that to life a little bit more, if someone had invested with us in the 2017 to 2018 tax year, that tax year vintage is currently sitting at 3.41 multiple to cost.

For someone who invested £100 ,000, that portfolio portfolio is now valued at £341 ,000. And in that tax year vintage, we’ve now returned £100 ,000 of that initial capital back to our investors. So they’ve got their initial capital back, and we are continuing to grow their portfolio in value.

In terms of failure rate, which is really important, our failure rate as a percentage of capital invested sits at 19%, which is market leading. So as you can see, there are going to be some companies that fail.

Typically, they fail at a seed stage. Occasionally, they fail at Series A. But our strategy shows that even if a company does fail, it’s supplemented by some significant gains with the remaining companies in the portfolio.

Marc Harris:

The prognosis for the next few years certainly got to be more of the same and probably only increasing in the variety and the pace of new businesses that are coming onto your radar, I suppose.

Mark Bower-Easton:

Yeah, absolutely. We haven’t seen any slowdown whatsoever in deal flow coming through. Our deployment continues to be, on average, one deal every six weeks or so. You can see from the statistics that the EISA, the Enterprise Investment Scheme Association, Create and HMRC give us that there is no shortage of companies looking to raise money through EIS.

It’s a one of its kind type of tax break. It’s great for entrepreneurs who are looking to create and grow businesses. It’s great for investors who are looking to back those businesses and get some tax benefits as well.

I think there’s a couple of companies in our portfolio that I would like to just highlight, and these companies wouldn’t have been able to raise money without EIS. The first company that I’d like to highlight is a company called Moneybox, which you may be familiar with.

It was created by Ben and Charlie back in 2017, who previously created a company called Bloom and Wild, the flower and gifting company, who, again, incidentally, raised a lot of money through EIS. Moneybox came to us with an idea.

They had no clients, they had no assets under management, and we committed to invest with them, dependent on them getting approval from the FCA. Since 2017, they’ve grown significantly. They now have a platform that has 1 .5 million active users and 7 .5 billion pounds of assets under management.

They’ve gone from having… having no revenue to revenues in excess of £100 million a year and they’re now profitable. We’ve invested into that company four or five times. We’ve backed that company from the seed stage all the way through to Series D and we hope that it’s going to be a very, very successful exit for those investors who were lucky enough to get in on one of those FolioScan .com who first invested with us or we first invested with them back in November 2021 at the seed stage.

They valued over seven and a half million. They were offering a platform where people who needed an MRI scan and didn’t want to wait for the NHS waiting lists could go onto their website, put their postcode in, put their body part in that they wanted to have scanned and within 48 hours you have an MRI scan.

have it reviewed and you either get discharged or you get referred. It started as a business to consumer business in the UK. It then pivoted to more B2B and since November 2021 it’s had a couple of funding rounds.

The latest funding round is to help it launch into the United States and that has been transformational for the business. It’s gone from where we invested back in November 2021 with revenues of maybe £400 ,000.

It’s now generating revenues of £65 million and without EIS it wouldn’t have been able to raise the sums of money that it has done. It wouldn’t have been able to launch into the United States and grow so spectacularly over such a short period of time.

Marc Harris:

Yeah fantastic success stories there and I’m sure if they haven’t ignited interest among viewers then I can’t think what would and for viewers that have had their interest ignited by what there are many other things that Mark has had to say, please have a look at all the contact details that we have beneath the video player.

There’s plenty of links through to Oxford Capital’s website where you can get in contact with Mark and his team. You can learn more about what they do. They’ve got lots of videos on their own website where they’re interviewing many of the founders of the companies that they’re actively investing in and you get a really good idea about who Oxford Capital are from their website as well.

So all that remains for me to do is thank you Mark very much for giving us an insight into EIS investing. It’s fascinating. Amazing tax breaks which is great. It sounds very interesting to be involved in any way simply for the benefit of following these exciting companie So thank you very much for taking us through the work that you do.

Mark Bower-Easton:

Thank you Marc.

Marc Harris:

My pleasure, my pleasure.

** The text within this document has been auto-generated from the original recording and therefore may contain small inaccuracies.

You may get in touch with Mark and the Oxford Capital Team using this form

Mark Bower-Easton

Head of Distribution

Mark has over 20 years of experience in financial services, qualifying as a financial adviser in 2004 and as a stockbroker in 2006. Prior to joining Oxford Capital in 2021, he spent the best part of a decade as a Partner in a FTSE 100 wealth management company, where he specialised in dealing with UHNW families, with a particular focus on tax advantaged investments, retirement and estate planning.

As Head of Distribution, Mark has responsibility for sales, marketing, product development and account management for key partners, private clients and family offices. He also sits on Oxford Capital’s Investment Committee.

BACKING FOUNDERS

SINCE 1999

We have invested in over 100 early-stage businesses that are solving commercial, technological or scientific problems in innovative ways, in sectors such as cyber security, fintech, digital health and Artificial Intelligence.

We invest through the Government backed, tax advantaged Enterprise Investment Scheme (EIS).

Watch these short video clips below to learn more about Oxford Capital

The above text, images, and videos representing Oxford Capital is a financial promotion for the purposes of Section 21 of FSMA and is issued and approved by Oxford Capital Partners LLP (“Oxford Capital”) 46 Woodstock Road, Oxford, OX2 6HT. Authorised and regulated by the Financial Conduct Authority under number 585981. Applications for investment in EIS funds/ portfolios managed by Oxford Capital, or investment in single companies, may be made only on the basis of the relevant Information Memorandum and application form, copies of which are available from Oxford Capital. No reliance is to be placed on the information contained in this document in making any such application. This material is directed only at persons in the UK and is not an offer or invitation to buy or sell securities.