Contact Canaccord Genuity Wealth Management

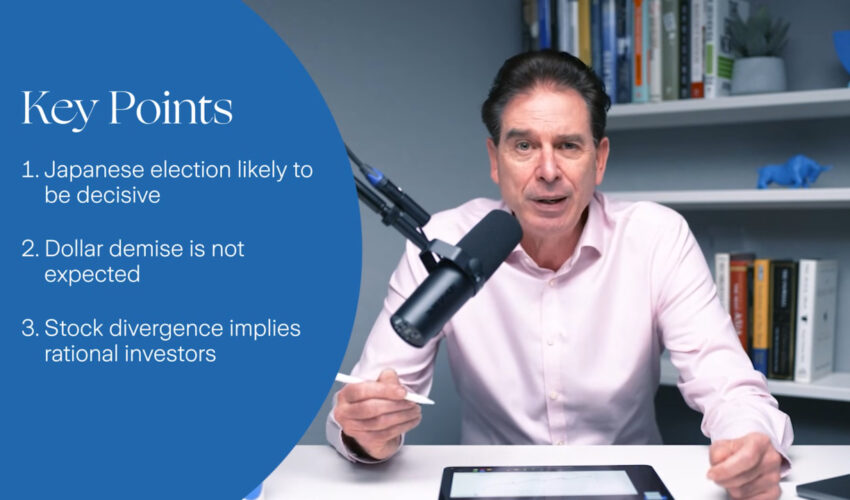

In our winter webinar, we looked back over 2025 as a year that rewarded investors who ignored the noise and focused on fundamentals. Global equities rose strongly, helped by steady economic growth and easing inflation, with Europe, emerging markets and the UK all contributing, not just the US tech giants. Bonds finally supported portfolios too, after several challenging years.

Looking ahead to 2026, the outlook is steady rather than spectacular. The US economy looks resilient thanks to fiscal support and strong consumer activity, while Europe and the UK remain more constrained. Inflation is easing and interest rates should fall again, which should provide a supportive backdrop for some fixed interest investments. Although geopolitics may spark volatility, we view this as an opportunity, not a threat.

From a sector perspective we will maintain exposure to technology and AI, while healthcare, consumer staples and utilities should provide stability for client portfolios.

This was first recorded on Wednesday 14 January 2026.

Investment involves risk. The value of investments and the income from them can go down as well as up and you may not get back the amount originally invested. Past performance is not a reliable indicator of future performance.

The information provided is not to be treated as specific advice. It has no regard for the specific investment objectives, financial situation or needs of any specific person or entity. It is accurate at the time of recording and is subject to change.

Canaccord Wealth is the trading name of Canaccord Genuity Wealth Limited (CGWL) and CG Wealth Planning Limited (CGWPL). They are all subsidiaries of Canaccord Genuity Group Inc.

CGWL and CGWPL are authorised and regulated by the Financial Conduct Authority (registered no. 194927 and 594155), have their registered office at 88 Wood Street, London, EC2V 7QR and are registered in England & Wales no. 03739694 and 08284862.