In this interview Marc Harris chats with Paula Fraser, Hugo Hill and Tom Andrew from leading adviser firm AAB. You’ll learn about Trusts and Family Investment Companies [FICs] and how they are often used in tandem to form an optimal strategy for business owners who wish to preserve and grow their wealth. Although these vehicles have been around for decades they’re seeing a surge in popularity due to the regulatory changes to Taxes such as Business Relief and IHT. They take approx. 6-8 weeks to set up so there is still time, just, to see if you can get them working for you before April 2026.

Q1. What’s driving the growing interest in both Trusts and Family Investment Companies among UK business owners?

Q2. How are families reacting to the impending changes to broader tax-landscape?

Q3. How do you explain the key differences between the two?

Q4. Tom, could you walk us through the typical structure of a Family Investment Company?

Q5. And what about discretionary trusts, how do you set one up, who are the points of control and benefits?

Q6. Hugo, in your experience are Trusts and FICs usually used together?

Q7. And from your perspective Tom, anything to add here?

Q8. Cyrstalise for us please the main advantages of using a Family Investment Company especially considering the current tax environment

Q9. In parallel Tom, what enduring advantages do trusts still offer in your view?

Q10. How do trusts and FICs contribute to the long-term vision, beyond the immediate tax benefit?

Q11. Do you find that families learn quite a lot about themselves when going through the set up process?

Q12. What does AAB bring to the table — solicitors, tax accountants, trust-specialist teams?

Q13. What kinds of assets are best suited for either of these structures, Tom?

Q14. With so much interest in FICs have you noticed any common errors in how they might have been set up or run?

Q15. Once the structure is in place, would you then recommend how the family governs their FIC and any linked trusts?

Q16. For investing through an FIC, does AAB typically work with external wealth managers, or do you support the client in selecting one?

Q17. Either from your own view at AAB, or in general: what scale of assets or business value makes a trust-and-FIC planning route appropriate?

Q18. Given changing tax policy, do you believe trusts or FICs might face further restriction in the next few years?

Q19. Paula, how long does the full process from concept to operating structure typically take?

The New Tax Landscape: Future-Proofing Your Wealth with Trusts and Family Investment Companies

The New Tax Landscape: Future-Proofing Your Wealth

with Trusts and Family Investment Companies.

*The text within this document has been auto-generated from the original recording and therefore may contain small inaccuracies.*

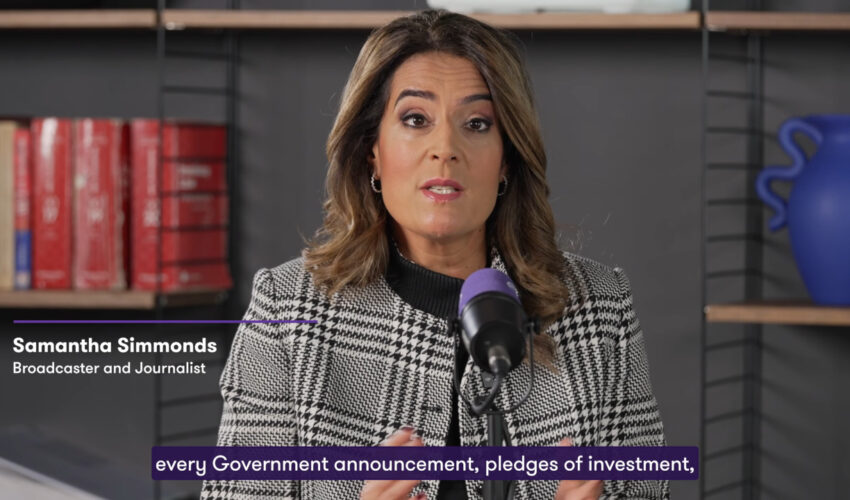

Marc Harris:

Hi, I’m Mark Harris, you’re watching Business TV, thanks so much for joining us. Given the tax landscape, every business owner, and especially those of you who have pushed past a particular wealth bracket, would be well advised to explore the advantages of setting up a trust or something called a family investment company. To talk us through what these are, how they work, who they’re for, I’m delighted to be joined today by Paula Fraser, Hugo Hill, and Tom Andrew of leading business and private client advisory firm, AAB.

Now, we’re in very good hands because AAB really are a professional firm that work at the highest level within a very competitive arena, and this is evidenced by the fact that they’ve recently picked up two very prestigious accolades at the Accounting Excellence Awards, namely Large Firm of the Year and Tax Firm of the Year and they’ve been shortlisted for Large Firm of the Year, Private Client Team of the Year and Managing Partner of the Year by the Yorkshire Accountancy Awards. Paula Fraser is head of private clients at AAB, she is a tax partner there, mainly looking after wealthy families and business owners. Hugo Hill is a director in the business advisory practise, again, looking after business owners and entrepreneurs, wealthy families, and much experience in setting up family investment companies.

And Tom Andrew is a senior manager in the private clients team, specialising in delivering tax-driven advice to families about their wealth planning and succession planning strategies. So we really are in very safe hands. Before I begin to gently interrogate my three esteemed guests, I just want to draw your attention to all of the wonderful information that we have sitting below this video as it plays on your screen.

There’s loads of links there through to AAB’s website where you can travel through to specific pages which will take you to where they specifically talk about the themes and the topics and solutions that we’ll be discussing in today’s conversation. There’s lots of ways to reach out to Paula and Tom and Hugo through forms. There’ll be some contact numbers there as well, you can click through and just simply reach out to them through their contact details.

So leave them a voicemail, send them an email, they’re happy to talk to you. And we’ve also made it very easy for you to quickly sign up to AAB’s insights section. So this is an area on AAB’s website where their experts are offering regular commentary on all of the sort of issues that affect you as a company director and or indeed as a private client.

So please check that out because it’s easy to do. Paula, let’s start with you. First of all, nice to see you again.

Thanks for joining us and making the time on Friday morning, two days after Wednesday’s budget. Thanks very much, nice to see you.

Paula Fraser:

Thank you.

Marc Harris:

Pleasure, pleasure. Paula, perhaps this is almost a slightly unnecessary question but there’s growing interest at the moment in both family investment companies and trusts. What is driving that wave of attention at the moment?

Paula Fraser:

I think, well, firstly, I think the trusts and the family investment companies FICs, I think we may be referring to them on and off throughout this presentation, have been around for a long time. They’ve been used by clients for a long time. They’re becoming more popular, I think, because of the last couple of budgets this week and especially probably last year when there was a lot of inheritance tax changes brought in.

But they have always been popular as part of the overall strategy when we look at inheritance tax planning for clients. They’re widely known, they’re very efficient for tax purposes. I know Hugo and Tom will talk about a lot of this as we go through this presentation. But yeah, they have become more topical and I think it’s probably the circumstances as to why they have become more topical and popular but they have been around for a long time.

Marc Harris:

And you’re obviously, you’re meeting with families and business owners at the moment. You mentioned the looming changes to the tax environment, IHT, business relief, et cetera. What’s the temperature of people at the moment? How are you finding business owners? Are some in panic mode, others perhaps more sanguine?

Paula Fraser:

I would say probably all of the above with lots of clients. Very different attitudes to it at the moment. There are those that are planning for the future and are nervous about the future and wanting to know what they can do, how to protect their wealth.

We’re talking to lots of clients, lots of families about solutions for inheritance tax and obviously Trusts and FICs will come into some of those solutions. But it’s very much looking at everything holistically for a client is what we’re doing and talking them through it. Sometimes it’s not as bad as they think it is.

So we talk them through the steps and say they are a little bit nervous but we talk them through all of that and help them plan for the future by looking at what it is they actually want to achieve with their family wealth and how they want to protect it. And then we talk them all through that.

Marc Harris:

When it comes to Trusts, Trusts is something that most people are probably gonna be familiar with. Perhaps family investment companies will FICs less so. Can you just quickly encapsulate for us the sort of principle differences between those two products before we sort of go into drilling into more detail about them?

Paula Fraser:

I think, I mean, they’re both really efficient in their own ways. They’ve got lots of tax efficiencies but by using them together, there are more efficiencies that you can achieve by using them together. I don’t want to preempt what Hugo and Tom are gonna talk about because they’re gonna go through all the various advantages, disadvantages of them.

But they are very, very tax efficient, as I say. And together, when you can use them together, there’s more efficiencies that you can gain from that.

Marc Harris:

So Tom, perhaps I can start with you then. Can you walk us through the typical structure of a family investment company?

Tom Andrew:

Yeah, absolutely. So, I mean, I guess as a starting point, kind of as Paul has said already, we kind of look at the position holistically. It’s quite a bespoke set of circumstances for every family and we want to make sure we’re working with them around those circumstances.

So we try to have quite detailed discussions at the outset around what the family dynamic is like, what they’re looking to achieve and kind of what their financial and business circumstances are really before we kind of dive into what the structure should be. But having said that, I guess some of the typical structures we tend to see quite often it’s where there’s a significant capital event. So where a business owner might be selling shares in a business that they’ve built up over many years and looking for what they might want to do with that capital after they’ve sold.

We also speak to people where actually the existing investment structure they have just isn’t working for them. So that might be personal ownership that is just not very tax efficient and also not particularly efficient for succession planning as well. And then also, we work with plenty of families where there is inherited wealth and they’re just looking to invest it tax efficiently.

I think it’s that combination really of ongoing tax efficiencies around the investments they’re holding that make VIX attractive, but also the long-term inheritance tax efficiency for the family unit as a whole as well. So I guess, just kind of walking back to that typical structure, when you’re thinking about inheritance tax planning, it often involves a trust holding some or all of the shares as well. And obviously we’ll kind of go into a bit more detail on how that might work and then also kind of different share rights as well.

So in the family investment company, we would often look at giving voting rights to the founder or to a trust they might set up to retain some control. We might look at implementing what are called growth shares where effectively, the founder might hold the freezer shares so holding kind of the initial capital put in, but actually all the growth is going to a trust or going to the children. And quite often as well, that structure that we’d look at would involve the founder actually lending funds to the VIX rather than investing everything through share capital, that allows them to draw that loan back out again at a future date.

And while they might retain that at the beginning of the kind of structure, and they might also look to give that away piecemeal over time, depending on the family’s circumstances. So I guess, kind of to summarise, there’s quite a lot of different ways that VIX can be set up. And I think that’s why it’s really important to speak to a suitably experienced advisor at the outset to make sure that you’re getting the right structure for your circumstances.

Marc Harris:

Yeah, indeed. A lot of very nuanced issues there, of course, which have to be evaluated on a case by case basis. You mentioned using these in combination with the trust, then let me ask you about the discretionary trusts in the context of your private client offering.

How are those set up? And what are the sort of points of control and the benefits?

Tom Andrew:

Yeah, so again, trust’s quite a flexible structure, I suppose. So again, it really depends on the family dynamic and sort of what you’re looking to achieve as to how a trust might fit into that. We’d always work really closely with a private client lawyer.

When we’re setting up a trust, we don’t sort of have a legal team in house, but we’re very sort of happy to work with existing family lawyers, or we can make introductions to one of the lawyers that we work with regularly who specialise in trusts and family investment companies. And I think that can be quite important to make sure that the lawyers are suitably experienced as well, because it is quite a specialist area. But what we always want is we want all of the advisors to be effectively singing from the same hymn sheet, so all kind of wrap around the family, so to speak.

Everyone knows what they’re working towards. And so we like to bring those outside experts in quite early. But then, sort of turning to the trust itself and how that works.

So the terms of the trust are governed by what’s called the trust deed. It’s a legal document, and it sets out who can benefit from the trust. So, that will often be children, grandchildren, you can include sort of unborn beneficiaries as well.

Sets out who the trustees are. That would usually be the people who have set up the trust or the FIC, and effectively allows them to retain some control over the assets and oversee the strategic direction of the FIC, not giving away that control too early. And then you’d combine the trust deed with what’s called a letter of wishes as well, which is, it’s a little bit more lurid, I suppose, in that that can change quite regularly.

So if the person who set up the trust wants to kind of change how it’s used, still within the terms of the trust, but perhaps there’s been life events that might impact who they want to benefit more than others. Actually, that letter of wishes can kind of set out what their thinking is at a given point in time. And so actually, if you’ve got a multi-generational kind of trust going, then even sort of 50, 60 years down the line, the trustees can say exactly what the person who set it up might want to achieve.

So, yeah, I think it’s quite a flexible vehicle. There’s usually quite a lot of discretion given to the trustees over who can benefit and when. And I think that’s quite important in the context of succession planning and FICs that actually the trustees can retain that control and it’s not kind of given to the children to decide.

Marc Harris:

Absolutely. And another thing that you mentioned there, which I think probably gives a lot of comfort is that you’re very familiar or well-disposed there to working with an existing professional advisor that the family might have, or perhaps a solicitor in this case. And I think that gives a lot of comfort, doesn’t it?

Because it means that your individual client can have the comfort that they’re bringing with them a somebody who they’re already familiar with, somebody who already understands their circumstances. And maybe there’s somebody who’s only around at the beginning of the discussion and later as things become more complex, they sort of get left by the wayside because it’s not their area of specialism. But it’s quite comforting to know that one can bring that professional advisor in on the initial conversations to make sure everything is set out properly.

Hugo, when it comes to either using a trust or using a family investment companies or both, I mean, are there situations where you sometimes might advise one or only the other, or are they normally used in tandem in your experience?

Hugo Hill:

I mean, every family is different, but we find a combined route usually gives the most flexibility. So when investments are held in a family investment company, I think, the income and gains corporation tax rate is 25%. So much lower than the 45% rate that you get in a trust.

And one of the big advantages of a FIC is that most dividend income, especially those from listed companies are not taxed in a FIC. There are exceptions, but generally they’re not taxable. We could also deduct running costs of the company for tax purposes.

So that might include investment management fees, accountancy fees, legal fees. And we could also do some direct remuneration planning in the FIC. So that might be through pension contributions as well.

With the trust, and from an IHT perspective, if we have trusts as shareholders, it could be really useful. So any future growth in the FIC will sit outside of your estate. And when the trust doesn’t own 100% of the FIC, you can usually get the minority discounts on your share valuation, which again would reduce your IHT exposure.

So that’s why we find most clients do enjoy that hybrid approach because it gives a great mix of flexibility and some tax efficiencies as well.

Marc Harris:

Tom, got anything to add there from your side?

Tom Andrew:

Yeah, I think, you know, I guess just picking up on what Hugo said around kind of the flexibility that’s offered from combining the two. I think trusts on their own, they’re definitely gonna be more limited in scope going forward, I think. So, I mean, we’re going quite a way back now, but in 2006, there were some fairly significant changes to inheritance tax.

And that quite limited what you could put into a trust effectively to the nil rate band, which is currently 325,000. So that was the most you could put in every seven years, unless it was an asset that qualified for business relief or agricultural relief. And I imagine a lot of the listeners will be familiar with the changes that were announced at last year’s budget limiting the relief that you can get for qualifying assets.

So now it’s just going to be a million pounds that can, you know, of business relief qualifying assets that can go into a trust every seven years. So, you know, whereas previously, you know, people might put several million pounds worth of qualifying assets into a trust, potentially before a business sale. Now it’s effectively gonna be a lot more limited.

So I think, you know, taking that all into account, bringing in kind of a thick and a trust together, you know, it allows you to have that growth and there’s no limit on, you know, the amounts of growth you can have in a trust. It’s the initial contributions to a trust that are limited. So I think, you know, for those who’ve got quite significant estates, the trusts aren’t going to be enough on their own.

You need to kind of have a think about what you can do to mitigate your inheritance tax position. And I think, you know, combining a thick and a trust could potentially be the answer.

Marc Harris:

Hugo, when it comes to the advantages, you rattled off some of the advantages earlier about FICs, but perhaps I can sort of ask you to expand upon those, especially if we consider the current taxing climate and what’s gonna be happening next year in April and the limitations that are then gonna be imposed. Can you sort of crystallise for our viewers that, you know, what the real advantages of the FICs are?

Hugo Hill:

Yeah, of course. I guess it’s probably best to kind of compare it versus like FIC versus investments held personally versus investments held in a trust. So as I mentioned previously, income and gains in the FICs are taxed at 25% at corporation tax rate.

But if those investments were held personally, the income would be taxed at personal tax rates. So 20%, 40% or 45%. And as announced on Wednesday, those are going up by 2% from April, 2026.

And then finally gains would be taxed at CGT rates. So 18 or 24%. And if those investments were held in a trust, the income and gains would be taxed at 45%.

So AAB typically, our clients are usually higher or additional rate taxpayers. So I guess in the FIC, they’re generally paying tax at a lower rate. And Tom’s already alluded to control, because I guess your viewers might be worried about if I put kind of money into a FIC or a trust, do I lose control versus if I hold on to them personally, I still have that elements of control in place.

And within the FIC, if they get the right advice on setup, they can still get a similar level of control in the FIC than if they held them personally. And the beauty of the family investment company and trusts is that they could also set out from the outset how they wish future generations can benefit from them as well. So it’s not just kind of next generation.

We’ve got clients that are kind of third, fourth, fifth generation now, which is fantastic. So that legacy can kind of go on for future generations. And then kind of finally, that growth in the FIC, they’re still enjoying growth, but it’s outside of their estate for out of state purposes as well.

So there’s lots of kind of advantages under the current UK tax environment that we can get with a FIC and a trust approach.

Marc Harris:

And Tom, when it comes to the sort of enduring long-term benefits of the trusts, anything else to add there?

Tom Andrew:

Yeah, I mean, as we kind of said earlier, I think one of the beauties of trusts really is how flexible it can be in terms of the way they’re drafted. So if you consider, for example, with a company, if you set it up from the outset and you were to give 10 shares each to your children and actually suddenly future life events that weren’t known at the time mean actually, you want to benefit one of them more than the other, perhaps one of them needs a little bit more income. It’s a lot more difficult to move around shares without triggering tax charges.

Whereas if those shares are held in a trust, it’s quite easy to actually benefit one person one year, benefit another another year. And the trustees throughout that process retain full control so that they’ve got discretion over who receives a benefit and when that will be, how much they’ll receive. And actually, while the founders are still alive, as I said before, they would generally be trustees.

So actually they’re fully aligned to what their wants are for the trust. And so they can build that in. And I think we see it quite a lot where trusts are set up for children, grandchildren and end up being used for combination of university fees, buying the first house, supporting them when they have their own children.

But there’s nothing in there that kind of binds the trustees where they would have to distribute. And I think that flexibility is really helpful. I think, just kind of going back to what we made about the benefits of combining trusts and FICs.

I think what people sometimes find is that FICs on their own, they’re great tax planning, but they do carry a bit of risk. If you bringing children in as shareholders from day one, you’ve got potential protection issues around the family assets and control issues as well. And that’s where the trust can be really helpful.

I think I’d just go back as well to the point mentioned earlier about making sure that appropriate advisors are involved. We’ve seen some pretty disastrous cases where prospective clients have come to us and shown us a trustee that’s been drafted. And in some cases that’s actually been invalid, but in other cases not met their requirements as well.

And so I think having a specialist involved from the outset when you’re dealing with something complex like trusts or FICs, I think is really important. And I guess, kind of a final point I’d make as well, just around kind of these complex family dynamics or people with significant wealth and what they might want to do to protect that. You could also look at what’s called a family charter as well.

And that is effectively a document that sets out clear principles around how a family’s financial and business affairs are going to be operated. It gets buy-in from all the family members involved. And it hopefully sort of helps to reduce future disagreements as well, because everyone’s signed up to it.

So that combined with trusts, FICs, is all a really important part of an effective family office.

Marc Harris:

Yes, I think one of the key points that we’re realising as this conversation unfolds is just the importance of sitting down and working with an advisor firm or a group of individual advisors as they need to be knitted together to really make sure that every single element and aspect is looked at carefully and professionally. So when these things are set up, everything has been considered. So I think that’s really important.

Tom, I wanted to ask you to expand upon something that Hugo was talking about earlier, which was the sort of the long-term generational vision that these have. Can you add to that from your point of view?

Tom Andrew:

Yeah, absolutely. I mean, so at AAB, I’d say we’ve got a real benefit of having really strong technical teams, both in trusts and FICs. And that’s been built up actually over a very long period of time.

So we have trusts that date back to kind of the early 1900s and some FICs that do as well. And I guess kind of going back to what you’re saying about this being like a long-term proposition is actually looking back at some of those trusts and FICs that have been a success story and have lasted that long and benefited multiple generations. I think that that really shows what an effective tool that can be, but also us having built up experience in that area for so long.

Again, I think sort of it just underpins really that we’ve got the expertise needed to help clients as well. We’ve also got an overarching family business proposition as well that encompasses trusts, FICs and also kind of trading businesses too. I think in terms of just going back to the succession planning aspect and the long-term planning, I think it really is quite a specialist area and it needs people who can kind of go above and beyond that day-to-day accounting and tax compliance work.

You really need to take a lot of time to get to know the families you’re working with and build a long-term relationship so that you can actually understand what they’re looking to achieve, what their goals are and help them to fulfil that. And I think often trust and FICs might be a big part of that, but also I think as you grow to understand that relationship over time, you’ll know which clients it’s appropriate for and which it might not be. I think there’s a lot of tax efficiencies around trust and FICs, but it’s also the protection aspects that they offer and the ability to kind of bring in the next generation at a time that the founder thinks is right, which I think really makes them quite popular with clients.

So I think that financial education pieces is really important in a wealthy family. You need to have a plan in place to actually speak to the next generation, bring them in, make them understand about the family wealth, how that’s built up, how that’s managed and actually introduce them to advisors at an early stage so that they’re understanding their position and hopefully not squandering the wealth that parents might have worked so hard to build up and protect. And then ultimately, I think that education piece helps the family feel able to relinquish control when the time’s right for them.

Marc Harris:

Yeah, so I suppose when you’re going through that process, on the one hand, you’ve got all of the technicalities of how these tools work and the advantages that they can bring and the technical side of the whole process, but you’ve got a lot of personalities and strong personalities to deal with as well, I’m sure, in that whole process. So dealing with all of those idiosyncrasies is quite a lot of the work that you do, isn’t it? The different personalities involved, working out how families operate within themselves and you’ve got all of those dynamics.

And of course, no family is ever plain sailing or smooth, is it? So I suppose you have all of those sort of strong personalities to deal with, which must be interesting work as well.

Tom Andrew:

Yeah, one of the best parts of the job, I think.

Marc Harris:

Indeed. And I suppose there must be quite a lot of, as you go through this with the individual clients, they themselves, I guess, are learning quite a lot about their own aspirations and or indeed the aspirations of other family members as you need to formally discover what it is people want to achieve. Perhaps a lot of the time families themselves learn what other family members really want when actually it comes to needing to make those aspirations and goals clear for the purposes of all these sort of structures to be working. So I suppose it’s a very interesting, exploratory exercise for lots of families?

Tom Andrew:

Yeah, yeah, I think that’s spot on. Yeah, absolutely.

Paula Fraser:

Yeah, I would agree. Absolutely. Sometimes find, I think, Mark, when you get into the discussions and you get to know the family, sometimes what they thought they wanted isn’t quite going to work because of those family dynamics and it comes out in those discussions.

I mean, at AAB, we, you know, we pride ourselves on getting to know our clients and their family. So we don’t, you know, it’s not a product for us, it’s something for the family to protect their wealth, which is, which is first and foremost for us is the client.

Marc Harris:

It’s a fascinating area because it really does as well illustrate the need for really good quality professional advice from people who understand those family dynamics. Because listening to the three of you talk, obviously, there’s a whole range of complex solutions that can be pieced together in almost an infinite number, an infinite number of combinations to make things happen in the way that people want. But of course, you can’t do that unless you’ve really crystallised in the first instance, what it is that everybody wants to achieve.

So I think that’s, I think that’s a very, I think that’s a very important takeaway from the from the entire conversation. And one of the key reasons why viewers need to get in contact, and then just to have an initial conversation. Hugo, when we spoke, and Tom has mentioned quite a bit about the different sort of advisors involved. Can you just sort of, again, perhaps crystallise for our audience, what, what it is that AAB bring to the table, how the various different advisors work with each other, just sort of give us a picture of how that process works.

Hugo Hill:

Yeah, of course. So I think it’s important to stress that FICs aren’t a one size fits all. And as Paula just mentioned, we need to get to know the family and the family dynamics as well.

So we make sure we spend a lot of time with our clients to really understand what they want to achieve, and really help design a structure that works best for the entire family. And that involves getting all the advisors around the table, as well. It’s not just kind of a conversation we can have, we need, we need like the investment managers, we need the solicitor around the table, as well, with the family.

And AAB, we’re a fully, fully serviced firm covering audit, accountancy, corporate finance, wealth and tax. So we can, we can help assist on the initial setup of the FIC and trusts. But as Tom’s already mentioned, we don’t, we don’t, we can’t help implement the legals.

So what we do is we work with some great firms of solicitors that can assist us and the clients with it. And also, we’re happy to work with existing family solicitors, as well. As I said before, it’s really important to work as a team on these. And in terms of ongoing compliance, they need specialist knowledge. So kind of what does AAB bring to the table? Well, Tom’s already mentioned, we’ve got dedicated teams in place, as we act for a large number of clients, with FICs and trusts. And kind of that experience has allowed us to develop real expertise in managing them. So we’re not only involved kind of from day one, we’re involved each year thereafter.

Marc Harris:

That joined element, all important. And again, something that you said, which I think is, again, interesting is that you said, although you don’t handle the legal element of it, you obviously, you have preferred legal partners who you do work with.

But the clients, perhaps incumbent legal provider is more than welcome to sit in on those conversations and have an initial discussion. And that’s sort of key, isn’t it, in terms of making sure that everything is set out and works properly?

Hugo Hill:

Yeah, and we make sure that we don’t just kind of leave them to it. We almost kind of project manage that side of things as well. So we’re overseeing the legal implementation, because ultimately, we’ve kind of discussed that structure with the clients.

And we want to make sure we’re involved from start to finish. So we do make sure we kind of project manage that element as well.

Paula Fraser:

I was going to say, Mark, can I just add there as well? I think you mentioned, you know, they might have a legal advisor who’s this is out of their remit. But that legal advisor could be a really trusted friend or advisor to that client. So absolutely, they’re involved all the way through as well. You know, they might not be able to do the implementation, but they know the family, they can help us understand the family at times. So we do involve them all the way through.

Marc Harris:

I think this question is for you, Tom. What sort of assets can be included within either structure or where one structure might be more appropriate than another? I don’t know if you can sort of just touch upon that for us.

Tom Andrew:

Yeah, absolutely. I mean, firstly, I’m going to apologise for trotting out a cliche. But we always tell clients, you shouldn’t let the tax tail wag the dog.

I think that’s always really important to remember in the context of FIcs and trusts. So we always like to make sure that a wealth plan is involved from the outset to actually, you know, there’s a lot of tax efficiencies that you can get with a FIC. But actually, you know, it needs to suit your investment profile as well.

And so it’s really important that the wealth plan is on board with whatever’s being planned and inputting into what investments are appropriate. So I think Hugo mentioned, we’ve got a wealth team in house that can do that, but also very happy to work with external planners as well, because we know a lot of clients will have their own financial advisors already. So we’re very happy to work with them too.

But I guess turning to, you know, from a tax perspective, what’s efficient in a FIC? So generally speaking, equities and funds made up of equities are pretty efficient, because Hugo mentioned earlier, those dividends that you receive are generally tax free in a FIC. Whereas things like corporate bonds or funds made up of those bonds can be less effective from a tax perspective, they’re subject to the corporate tax loan relationship rules, which effectively means all the returns end up being taxed at 25%.

So there’s no kind of tax free element like there is with the dividends. Obviously, you know, if you do have taxable income and capital gains that you’re realising, there’s things that you can do like deducting investment management fees that you wouldn’t be able to deduct personally. You know, directors remuneration packages as well can help with the tax efficiency, it can bring down that taxable income in the FIC.

So you know, even if you do have investments that are generating taxable income, and obviously realising some capital gains as well, you know, that can certainly help with the tax efficiency if you’ve got some of those expenses that you can offset. And then I think really the other asset class that’s become really popular in FICs is property as well. So a lot of landlords and property investors, they’ve been looking at FICs in particular over the last well coming up to 10 years really, since the mortgage interest restrictions came in.

But also, just kind of turning back to the budget that we had a couple of days ago, they’ve announced a 2% increase to property tax rates as well. So I think, you know, those sorts of people who were maybe just on the edge as to whether a FIC will be better or, you know, their existing structure might be considering a FIC now. What I would say is, if you’ve got a property portfolio, actually incorporating an existing portfolio can be quite difficult from a tax perspective, versus, you know, starting a fresh investment company that you’d affect any new purchases through.

But it can be possible to, you know, to incorporate an existing portfolio. You just need to take appropriate advice. There’s been quite a lot of, I’d say, bad advice out there and particularly on social media.

And, you know, I think it’s been quite widely publicised more recently around some of these, you know, schemes involving property incorporations. So I’d really urge any landlords thinking of incorporating to make sure they’re getting the right advice, because it does seem to be an area where there’s quite a lot of, you know, misinformation out there at the moment. So, you know, I think the advice is really key there.

Marc Harris:

Yes, indeed. And I think as people investigate the appeal and the advantages of a FIC, obviously it can be, it’s very, very tempting to jump into one very quickly, isn’t it? And then you say, as you say, then make mistakes. Hugo, I mean, part of your bread and butter work is setting up FICs. What sort of common mistakes do you see that people have made? Perhaps you’re often having to pick up the pieces of, you know, those sort of mistakes.

What sort of common things do you see?

Hugo Hill:

Yeah, and I guess it is down to the recent rise of interest and popularity in FICs. I mean, they’re not a new concept. They’ve been around for decades.

And Tom mentioned earlier, we’ve got trusts and FICs that are nearly 100 years old. So we’ve been dealing with them for a long time, and they’re not new. But I guess popularity is down to the low CT rates compared to the relatively high personal income rates that are around at the moment.

So kind of the challenge that we see, and with FICs, is that we’re seeing firms without much experience in them, advising families on them. And so just like a couple of examples that we’ve seen recently, we’ve seen accountants that have filed unlimited company accounts, companies house, when they didn’t need to. And I guess that’s down to not actually knowing much about them, whereas actually they’re a great way of maintaining privacy.

But we’d only recommend that if the FIC held listed investments only and not property. And a second example, we’ve obviously taken on a lot of existing FICs as well. And when we’ve taken them on, we’ve seen that they’ve kind of accounted for investments incorrectly, and has a knock-on effect on the tax return as well.

So we’ve seen mistakes there. And I guess I just want to stress the importance of having specialist teams involved here, because the tax treatments of underlying investments can be really complex, and it’s not something you want to get wrong when HMRC come knocking at the door. So yeah, it’s important to get the right people involved with FICs and trusts.

Marc Harris:

Yeah, definitely. And I think for a lot of company directors, that really is such a key thing, because whatever advantages one might be able to win, it’s just not worth doing anything if, one, you’re just not going to have the peace of mind that things have been done properly. But two, something does go wrong, and then you are under the eye of HMRC later along the line. For most company directors, it’s just not worth it. So really, really important to do things properly from the outset. But a great comfort to hear you explain that these tools have been around for circa 100 years.I mean, again, it’s worth reiterating, isn’t it? These are mainstream vehicles that have already had a lot of scrutiny from HMRC. It’s just that they need to be set up.They need to be set up properly.

Once the structures are in place, Tom, perhaps a question for you. When it comes to how the family should go about the ongoing governance of the FIC and its investments and the trusts that it’s linked to, is this an area that you get involved in and make recommendations against?

Tom Andrew:

Yeah, absolutely. So, I mean, we’d always recommend that where you’ve got a FIC and, well, and usually a linked trust as well, that you have at least an annual meeting where all the advisors are in one room and kind of maybe all of the family as well, depending on, you know, the family dynamic. I think it’s really important that everyone involved has, you know, joined up approach effectively.

And that whole team that’s looking after the client is in the loop on any developments. I think it’s never good where, you know, sort of advisors hear things that have happened secondhand almost. You know, you want an effective team that can service a client.

So, everyone needs to be working together. I think as well, where you’ve got advisors that have got real experience in that kind of family business space as well, you know, not just kind of the trust and FIC specialism, but kind of working with families across multiple generations to manage their wealth, often in kind of a, you know, family office style structure where that’s appropriate as well. I think, you know, where you’ve got people who have that kind of experience, it really makes a big difference to the service that clients get and it can actually help with the family dynamic as well.

I think, you know, if they’re receiving poor advice or kind of ongoing governance, if there’s any kind of fractures within the family, it can sometimes actually make those worse. So, you know, it really is key that everyone kind of knows what they’re doing, I would say. And then I guess in terms of ongoing governance as well, I mentioned family charters earlier that, you know, it’s not appropriate for every family, but they can be really helpful if you incorporate that into, you know, an overall kind of governance structure.

And, you know, again, it just, it gets everyone’s buy-in at quite an early stage. Everyone agrees as to how things are going to be run and hopefully just helps prevent future disagreements. And I think the final thing I’d say governance-wise as well is it’s just really important to document everything as you go along, any kind of decision-making, minutes of meetings, you know, and yeah, I think particularly when it comes to things like scrutiny that you might get from HMRC, you know, you want to make sure that you’ve got the appropriate documentation in place to show what’s been done and why. And that can really just reduce risk for the family. You know, nobody wants a retracted HMRC enquiry that could potentially have been avoided if you had all the correct documentation in place.

And also I think, you know, thinking multiple generations ahead, actually, if you’re documenting everything very clearly from the outset, again, it hopefully helps, you know, demonstrate how the founders want everything to be run, what everyone had signed up to and why decisions were made and hopefully just helps the, you know, the FIC and the Trust stay in place for the long term rather than potentially being wound up because of, you know, infighting in the family.

So I think, you know, I think governance has a really important part to play in both FICs and Trusts for them to be effective.

Marc Harris:

Paula, when it comes to the, obviously one of the big advantages of the FIC is its ability to make investments. Very often that process also, because company directors are busy running their businesses, maybe simply don’t have those skills, that’s something that would be handled, if I’m right in saying, by a wealth manager. Is that correct?

Do you recommend a wealth manager that might be a particularly good wealth manager for a FIC of a particular size or that’s holding a particular type of assets? How does that element work?

Paula Fraser:

I guess, well, I think as Hugo and Tom have both referred to, you know, we internally, we have our own wealth function as well. So we have AAB Wealth who we work with on a lot of FICs. But yeah, we also work with a number of other external IFAs and wealth advisors with regard to FICs.

So again, it comes down to our relationships that we have with other intermediary firms. But yeah, we can obviously help clients select a wealth provider if they want us to do that, but they tend to come with us. If they’re new clients to the firm, they will already have an IFA or some form of advisor or alternatively, you know, we can make recommendations to them. And as I say, you know, we can use our own in-house wealth team as well for that and give them guidance around the investments that they need for their FICs.

Marc Harris:

A two pronged approach.

Paula Fraser:

We work with external ones and we have our internal one, you know, either is fine, absolutely fine with our tax team. But provided they, you know, as we were saying, provided it’s part of a wider team and we’re all working together, so we all know what the family goal is. Yeah, we can work with most advisors on this.

Marc Harris:

What sort of asset level does one need in order for all this to stack up financially?

Paula Fraser:

I think, you know, as we’ve covered and people will probably realise that there is a lot of compliance needed with the FIC and the trust. You’ve got reporting requirements, you’ve got accounts, you’ve got things you need to do, governance and board meetings. At AAB generally, there’s no line as such for the size of a FIC.

You know, we’ve got a lot of FICs with existing clients, two million, three million plus. But equally, there’s a lot of smaller FICs at AAB. They always operate as efficiently as a bigger FIC. It just depends on the client circumstances. So there’s no line. It really depends on what the client is wanting from that FIC and what it is they want to invest in. But there’s no real line as such for a FIC. It depends on the client and the circumstances.

Marc Harris:

Right. And of course, many of you out there will certainly be fitting into that bracket. Tom, when it comes to the, obviously, we’ve got all this looming changes to the tax policies.

Do you think that because of that and because of so much interest in FICs now, that they are now going to start attracting more scrutiny from HMRC or more limitations perhaps placed on them? And therefore, like now is the time to act before they start messing around with one’s ability to use a FIC?

Tom Andrew:

Yeah, I mean, it’s quite a timely question, isn’t it? I think you obviously alluded to and we mentioned before, there was the budget just a couple of days ago. And I guess, you know, we’ve had a couple of changes which will impact the efficiency of FICs and trusts.

So, you know, the dividend rates going up at the basic and higher rate and property tax rates going up across all bands, certainly at least in England and Northern Ireland, you know, and, you know, may well end up going up in Scotland as well once the Scottish budgets concluded next month. But I mean, one thing I would highlight is there was no change to the rate of corporation tax in the budget. And actually, you know, as I mentioned earlier, I think the property tax rates going up might actually mean that more people do look to FICs.

And, you know, similarly with the dividend tax rates as well, people who have got personal ownership of assets, you know, might just see that it’s not as efficient as it used to be and might be more appropriate. I think with FICs, with trusts, and I guess with any kind of asset planning, there’s always going to be kind of ongoing risks that you’ve got to assess around changing tax policy. You know, I’ve been in tax nearly 10 years and, you know, there’s been lots of change in that time. There’s some years where not a lot changes. And then certainly in the last couple of years, it felt like nearly everything’s changed. So I think, you know, you’re always having to constantly assess, is this the right structure for me?

You know, are my assets held as efficiently as possible? But I think, you know, going back to what we’ve kind of said throughout today, you know, we’ve got FICs and trusts that are decades old. They’ve survived, you know, a lot of changes to the tax landscape.

And I think as well with FICs and trusts, they are not a short term planning vehicle. They are, you know, they’re there for the long term. So you effectively, you need to be prepared to ride out some changes that might not be as efficient, you know, and there will hopefully be years where, you know, it’s very efficient as well.

I guess specifically on FICs though, HMRC had a FIC team a few years ago that they actually ended up shutting down. They undertook a review of FICs and actually they found there was no evidence of increased tax avoidance risks, sorry, tax avoidance risks that are specifically associated with FICs as compared to, you know, any other kind of vehicle or investment holding structure. So I think that probably provides a bit of comfort for people who are, you know, who have existing FICs or are going into it now is that actually, you know, it doesn’t necessarily mean HMRC have signed off on them.

I think there’ll always be, you know, scrutiny over, you know, how it’s being operated. And, you know, they’ll continue to monitor FICs as they continue to grow in popularity, but there’s not been anything to suggest that HMRC are, you know, going to specifically attack FICs based on, you know, based on what their review found a few years ago. So, you know, they are, as we’ve kind of said, a very common vehicle that’s been around for a very long time.

It is effectively just a limited company as any other is that holds investments. There’s, you know, so it’s, you know, hopefully something that HMRC are not going to be attacking. And I think, you know, there’s probably as much comfort as you can ever get with HMRC that, you know, that they did close down that FIC team.

Marc Harris:

And as you rightly point out, nobody’s got a crystal ball. Nobody, it’s absolutely impossible to implement any structure that one can be convinced is going to be bulletproof for the long term, 12 months, 18 months, 10 years, whatever that long term might look like. Things are constantly changing, aren’t they? And it’s a question of simply being agile and responding to what’s going on in the moment. But, yeah, nobody’s got a crystal ball.

It’s impossible to forecast these things. But as you said, they’ve already come under a tremendous amount of scrutiny in recent years. They’ve been around for a long time.

And they’re essentially a limited company structure. So it’s something that everybody’s very, very familiar with. Paula, we’ve spoken about the importance of getting all of the moving parts to these understood and accurately documented and all the different advisors working together. Can you give us an idea, taking all of that into consideration? And again, it’s perhaps a difficult question, because every FIC is going to be different. Trust is going to be different. Family structure, size, size of businesses, investments that they want to make, everything’s going to be different. But typically, what sort of amount of time investment is required from everybody involved? Everybody gets together, sits down, has a meeting, has a Zoom call like this, perhaps in many cases. And then you all go about busily getting on with the work that you need to do to put everything together. How long does all that take from start to finish?

Paula Fraser:

I think from experience, typically, you start the conversation with the client, generally inheritance tax planning and talking about the family, what they’re wanting to look at, what they’re wanting to achieve. FICs and trusts become part of that discussion. We go into quite a lot of detail with the clients.

We set out the FIC, the trust and other options, which they can consider with regard to their planning. And if they’re then going down the road of, let’s say, a FIC with a trust owning that FIC, typically, you’re probably looking at three to four weeks of the discussions, the family discussions, the technical research, making sure it fits their circumstances. And once they then decide they want to go ahead, you probably look at another two to three weeks after that, liaising with the lawyers, getting the documentation done, getting everything reviewed, getting everything in place.

And then you’ve got the actual implementation where everything will then happen. So typically, on average, you say, depending on the size of the client, you’re probably looking at one to two months from start to finish. Obviously, with much bigger clients, it might be a longer period because there’s more things to think about.

But I would say, typically, six to eight weeks is pretty standard for getting the whole structure in place.

Marc Harris:

That’s not too onerous, is it? And I suppose quite early on within that process, one has decided whether or not you’re going to continue to go down the road of setting one up, I suppose.

Paula Fraser:

Yes. It is because you can, when you have those discussions with the client and their family, it depends on what they’re telling you they’re wanting to do or what they see in the future. And I think as Tom and Hugo have alluded to in prior questions here, sometimes the FIC isn’t the right thing for it. Sometimes it isn’t.

It becomes pretty obvious to us quite quickly if that structure is going to work for the family or if it’s going to be something else. I would say, and if it is that FIC and trust structure, then obviously we’ve got all the experience in-house, we’ve got the wealth advisors, we’ve got everything we need apart from the legal. So we can get that process moving pretty quickly for a client and say, usually a couple of months to get everything in place.

Marc Harris:

And worth pointing out that of course, if one gets into a discussion with yourselves and the initial motivation is to set up a trust or a FIC, great if that happens. But equally, if you think that it’s not right for the client, you’ve got a whole suite of joined up services that you may well end up suggesting something completely different that they hadn’t thought of, even though they came to you with the idea of setting one of those up in the first place.

Paula Fraser:

Yeah, absolutely. Because people will have heard of FICs, people will have heard of trust and they think it’s right for them and they come to us and they say, yeah, I want to do this. And when you start talking to them and explain what it is and what it’s about, it probably doesn’t or sometimes doesn’t fit their circumstances. And we will explain that to them. And yeah, we absolutely have alternatives that we will talk through with them.

Marc Harris:

Well, Paula, Tom, Hugo, thanks so much for taking us through FICs and trusts and how they work in tandem. It really is a fascinating topic, one that’s clearly ever more pertinent and amplified by the recent budgets that we’ve had, which I think have been universally quite unpopular, especially from the perspective of business owners.

So thanks very much for taking us through those. Please reach out to Paula, Hugo and Tom through all the mechanisms and tools and links that we provide you beneath the interview as it played. So all that’s left for me to do is thank you all for joining us on Business TV.

It’s been a real pleasure. Thanks.

Paula Fraser: Hugo Hill: Tom Andrew:

Thank you.

Please get in touch with Paula, Hugo & Tom using this form

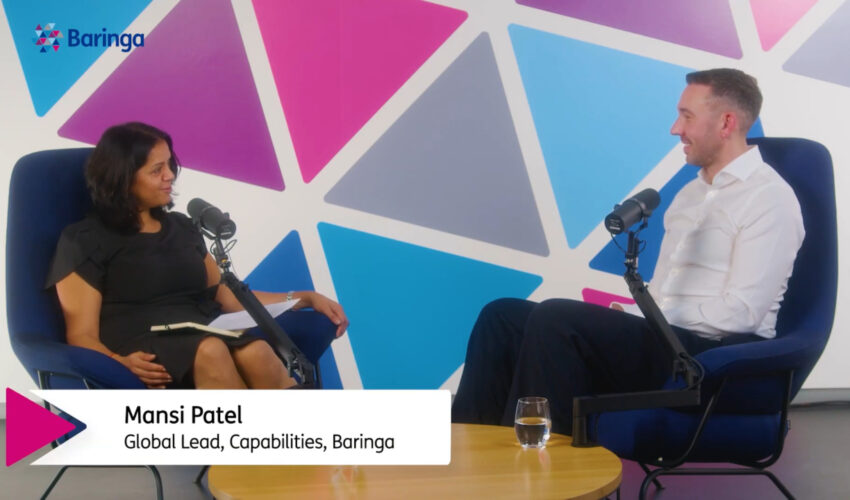

Paula Fraser

Head of Private Client

AAB

Paula Fraser is a Tax Partner and our Head of Private Client for the group. With a background in entrepreneurial and private client tax, she deals with entrepreneurs, family businesses, high net worth individuals and families, providing them with holistic tax advice and bespoke solutions to their individual needs.

As well as heading up the Private client team, Paula also sits on the Family Business team. She believes clients enjoy working with her because she is honest, and stays calm and level-headed, even in the most difficult circumstances.

“Anyone can sell tax advice, but not everyone makes it relevant. To provide the very best service to my clients, I have to get to know them, get to know their families, and understand the dynamics at play. I need them to open up and talk about what they actually want to achieve.”

Hugo Hill

Business Advisory Director

AAB

Hugo Hill is a Director in our Business Advisory team. Based in Leeds, Hugo’s client portfolio predominantly consists of owner-managed businesses, family businesses, and family investment companies.

One of the reasons Hugo enjoys working with his clients and finds it so interesting is that they cover such a wide range of sectors and industries. He particularly appreciates client relationships in which there is regular, consistent support, through speaking and meeting a number of times throughout the year.

“For me, the ideal relationship is one in which we are in communication throughout the year, as this allows us to be proactive rather than reactive. In my view, it’s much better to be able to proactively avoid problems and issues rather than having to be reactive and solve problems after they’ve already occurred.”

Tom Andrew

Private Client Senior Manager

AAB

As a Senior Manager within our Private Client team, Tom Andrew specialises in undertaking bespoke tax advisory projects for a wide range of clients, from advising internationally-mobile executives on residence and domicile issues to advising family businesses on succession planning and restructuring.

Tom also helps clients who may have made errors in making thorough disclosures of any underpaid tax to HMRC, whilst seeking to minimise any financial penalties. He is a member of our International Tax team, as well as our Tax Investigations team.

“For me, the ideal relationship with a client would be one that is long-term, in-depth, and trusting. Clients expect me to be accurate and to provide them with timely advice. However, they also expect me to have a deep appreciation of their specific circumstances – and to be a friendly face they can turn to.”

Our team support a diverse array of individuals such as employed professionals, business owners, families and international sports stars. As AAB clients, they all benefit from absolute confidentiality and share a unified goal of optimising and safeguarding their personal wealth.

TRUSTS & FAMILY INVESTMENT COMPANIES

A Family Investment Company (FIC) still offers much of the control and flexibility provided by a Trust, but with greater tax efficiency from which the founder (the person putting the funds into the company) can also benefit. We can discuss the pros and cons of each approach and advise you on whichever route you choose.

TAILORED FINANCIAL PLANNING

AAB Wealth offers tailored financial planning to help you achieve the best from life. Financial planning is a process that helps you make sensible decisions about money. It covers planning for your future using tools such as Cash Flow Modelling, retirement planning, inheritance and succession planning and tax planning.

Find below some latest insights from AAB experts

AAB in the news

Hear from David & Claire from AAB Wealth

John & May, and Carol share their experiences working with David Neely, Financial Planner at AAB Wealth.

Claire Marson, Chartered Financial Planner at AAB Wealth, breaks down the power of cashflow modelling.