Marc Harris chats with Andy Denny, Director of BCMS, to give a clear idea of how selling a business works in practice. Andy explains how he and his team take a deep look at your business’s activities and strengths and how they use this information to create a portfolio of potential domestic and international acquirers or investors. As you’ll learn, there are many exit options on the table, and BCMS will help you identify a strategy that best suits your goals. Andy covers key issues such as – time frames – how they create a competitive stable of buyers – the profile of buyers who drive the most value (you maybe surprised!) – what sort of information they require from sellers – BCMS’s independent approach that means they are only working for you the seller.

Use the Chapter links below to travel to specific places in the conversation

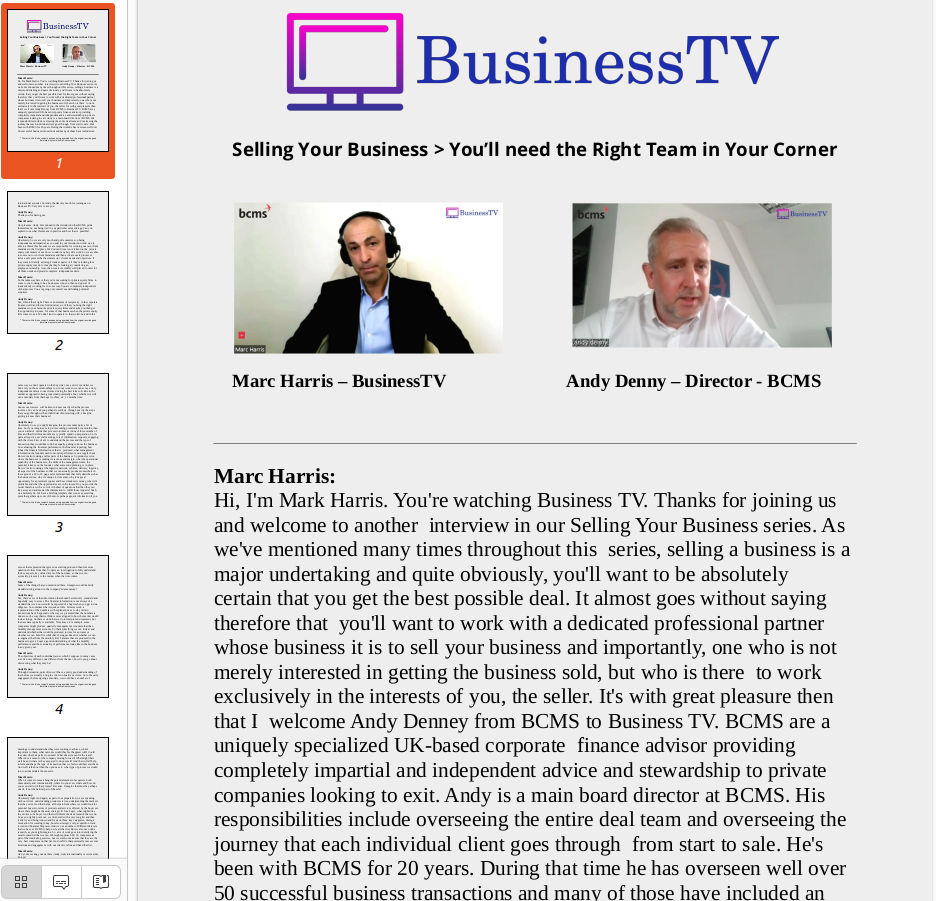

Introduction: BCMS and my guest Andy Denny, director and head of deal team.

Ch 1. BCMS pride themselves on not being tied to any particular sales strategy, can you explain to us what this means in practice?

Ch 2. Getting to know the clients’ business.

Ch 3. What information is usually availible?

Ch 4. Researching the potential market of acquirers.

Ch 5. Forming a picture of the owner managers’ role.

Ch 6. People always play a significant element in the process.

Ch 7. How creating that competition works in practice?

Ch 8. What are the common exit options that exist for the owner?

Ch 9. Realistically,when should owners begin the process?

Ch 10. When is the best time in a company’s life cycle to sell the business?

Ch 11. Keeping the sale confidential must be challenging / are NDA’s necessary?

Ch 12. BCMS are the only UK corporate finance advisor who are employee owned.

Selling Your Business > You’ll need the Right Team in Your Corner

** The text within this document has been auto-generated from the original recording and therefore may contain small inaccuracies.

Marc Harris:

Hi, I’m Mark Harris. You’re watching Business TV. Thanks for joining us and welcome to another interview in our Selling Your Business series. As we’ve mentioned many times throughout this series, selling a business is a major undertaking and quite obviously, you’ll want to be absolutely certain that you get the best possible deal. It almost goes without saying therefore that you’ll want to work with a dedicated professional partner whose business it is to sell your business and importantly, one who is not merely interested in getting the business sold, but who is there to work exclusively in the interests of you, the seller. It’s with great pleasure then that I welcome Andy Denney from BCMS to Business TV. BCMS are a uniquely specialized UK-based corporate finance advisor providing completely impartial and independent advice and stewardship to private companies looking to exit. Andy is a main board director at BCMS. His responsibilities include overseeing the entire deal team and overseeing the journey that each individual client goes through from start to sale. He’s been with BCMS for 20 years. During that time he has overseen well over 50 successful business transactions and many of those have included an international acquirer. So Andy, thanks very much for joining us on Business TV. Very nice to see you.

Andy Denny:

Thank you for having me.

Marc Harris:

Our pleasure. Andy, I mentioned in the introduction that BCMS pride themselves on not being tied to any particular sales strategy. Can you explain to us what this means in practice and how that is possible?

Andy Denny:

Absolutely. So we are very much and pride ourselves on being independent and impartial, as you said in your introduction. And we are able to achieve this because we are responsible for winning our own client mandates in the first place. We don’t and we are not reliant on the private equity community or nor do we conduct any buy side work. So we are able to source our own client mandates and then activate a sale process or tailor a sale process that best meets our client’s needs and objectives. If they want to identify a strategic trade acquirer or if they’re looking for a private equity investor or maybe they’re looking at considering an employee ownership trust, then we are incredibly well placed to cater for all those needs and provide complete independent advice.

Marc Harris:

So the takeaway here is that you’re not waiting for private equity firms to come to you looking to buy businesses who you then end up sort of inadvertently working for in some way. You are completely independent of that process. You are going out yourselves and finding potential acquirers.

Andy Denny:

Yes, I think that’s right. There is an element of reciprocity in the corporate finance world and form of introductory work that you bring the right mandates to your favourite private equity firms and maybe you then get the opportunity to quote for some of that business when the private equity firm comes to exit. We don’t tend to operate in that world. So and in the same way we don’t operate on the buy side or as a sector specialist, we don’t rely on those relationships to win our work so we can act as a truly independent advisor to our clients driving the best terms of value in the market as opposed to being concerned potentially about whether we will win a mandate from that buyer in three, six, 12 months time.

Marc Harris:

I know our viewers will be keen to know exactly what the process involves. So can I ask you perhaps to walk us through exactly the steps that you go through with an individual client starting with, I imagine, getting to know their business?

Andy Denny:

Absolutely. So as you might imagine, this process takes quite a bit of time. So if you imagine a sale process taking potentially nine months, then you can kind of divide that process into three sections of three months of time and that first three months are typically spend on preparation. So it’s quite a deep dive, several meetings, lots of information requests, engaging with the client. First of all, to understand the process and the type of transaction they would like to do but equally getting to know the business. So evaluating the financial performance, the financial reporting, how robust the financial information is that is produced, what management information the founders used to monitor performance on a regular basis. But we’re also looking at all aspects of the business. So product service, where the business is making its revenue and margin, what the operational capability of the business is, the skills of the management team, the potential reliance on the founder, what succession planning is in place. But we’re also looking at the logistics network, vehicles, delivery, logistics, all aspects of the business so that we can actually produce somewhere in the region of a 25 to 35 page sales memorandum that fully describes what the business does, why it’s unique in its market, why it’s a great opportunity for a potential acquirer and how it makes its money, where it’s profitable and what the opportunities are in the future. Do you provide the owner therefore with a sort of crib sheet of questions that then they can take away and and muster the information to fulfill those requests? Yeah, we absolutely do. We have a briefing template that we use as a starting point that gathers up some of the more perhaps generic information if you excuse that expression that gives us a starting point and then lots more questions follow from that. So quite an interrogation to fully understand the key aspects, key value drivers of the business, so that we can accurately present it to the market when the time comes.

Marc Harris:

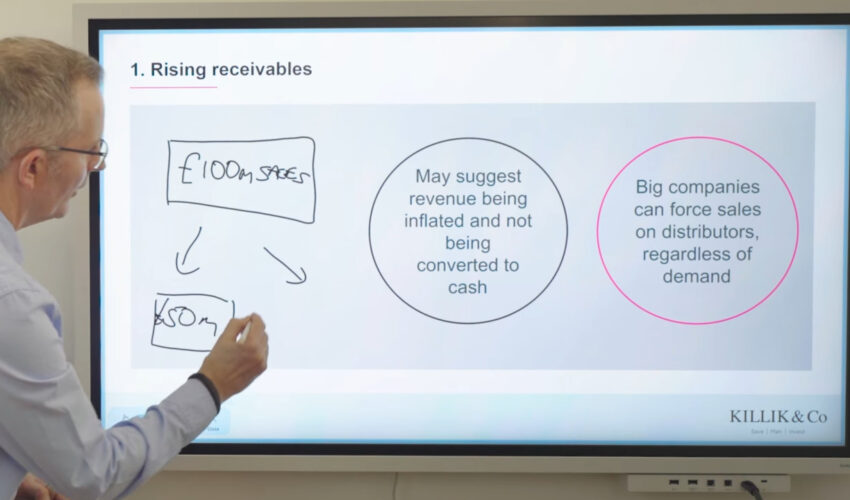

Some of the things that you mentioned there, I imagine would be fairly standard sitting around in the company’s data anyway?

Andy Denny:

Yes, there’s a lot of that information that should be relatively standard and hopefully easy to access. The financial information is not always of a standard that we know would be expected of a buyer when you get to due diligence. So sometimes that requires a little bit more work, a representation of the numbers with explanations as to why certain transactions have happened or the way we presented that the numbers is done in such a way that we think is more aligned to how the market would look at things. So there is work that we do to interpret and represent, but the base data typically is available. Not always. For example, some companies might produce quarterly management accounts rather than monthly management accounts. So that’s something we can look at and understand whether that could be produced in time for a process or whether we can hold fire while that’s being produced or whether we can re-engineer that from the monthly trial balances that are produced in the business to give a buyer a good understanding of what the monthly performance and the seasonality of performance looks like in the business in any given year.

Marc Harris:

The objectives of each individual owner, which I suppose in many cases are often very different, one different from the next, how do you go about discovering what they may be?

Andy Denny:

Through discussion, quite often we’ll have a pretty good understanding of that before we actually bring the client on board as a client. So in the early engagement before signing a mandate, we would have a number of meetings to understand what they were looking to achieve, what’s important to them, what outcome would they feel happiest with? Could they describe their perfect outcome? What does it mean for the team? What does it mean for the company moving forward? What might their well be and what are they prepared to do post-sale? And that will all help inform and shape the type of transaction that we feel would best suit them. And we’ll talk about then the options as to what type of process we would run to accommodate those needs.

Marc Harris:

When it comes to researching the potential market of acquirers, both domestically and internationally, where do you even, where and how do you even start with that process? Because I imagine that must be perhaps one of, if not the hardest part of the sale?

Andy Denny:

Absolutely right. And again, as part of our preparation, we are speaking with our client understanding product services, understanding the markets that they serve. And that helps, all helps inform where we would look for potential buyers in terms of products and services offered by the buyer set, where there might be the most strategic fit for a buyer, what might drive the motives of a buyer. And that will inform the desk research that we do. So as you rightly point out, we often start with a very long list and then really try and bring it down and focus on three key categories, strategic motivation for wanting to buy, but also strategic, sorry, acquisition track record and financial firepower. And we use a number of different data sets that we have at BCMS to help us create that list. But we also use online research, as you might imagine. So a lot of work goes into identifying the most focused list that we can. We might approach 40, 50 companies as part of that marketing exercise, but we want to make sure that they are the very best companies on that list. And we’ll do that potentially over several iterations and engagement with our client to refine and hand that list.

Marc Harris:

And you’re casting your net here, Andy, truly internationally or is it mainly Europe?

Andy Denny:

So I would say the vast majority of international buyers would be European, Scandinavian, US. But that doesn’t limit us. We will look at South America, we may look at Asia, we may look at Australia, it really will depend on where the right companies are operating of the right size and the right strategic operation that would generate the right interest in our client’s business. So products and services, opportunity for cross-sell, opportunity to diversify, complementary product sets will all determine which companies we look at. And that ultimately determines where they’re based as opposed to the other way around, if that makes sense.

Marc Harris:

This process must be an interesting one for the company only to witness as it unfolds, because I’m sure that you’re very often coming up with companies that they wouldn’t have ordinarily had on their radar?

Andy Denny:

Absolutely right. It’s very rare that we actually end up selling to a business that was known to our clients at the beginning of the process. So we are informing them of the businesses that are out there, we are creating profiles around those potential buyers and educating our clients as to why we want to approach them, what the strategic motives may be for an acquisition and then bringing them into the process. We’ll never engage with anyone the client hasn’t approved, but very often they are happy to go with our expertise and guidance in that regard. But having that, that’s a set of differently motivated buyers that all want the business for slightly different reasons, typically complementary product sets, services, geographic presence, as opposed to key competitor and taking a competitor out of the market, we find drives up value for our clients.

Marc Harris:

Andy, we always hear that the management team is a vital asset to the business and a vital component when coming to sell the business. Can you explain to us then how you take a look at that people element and what’s involved in that?

Andy Denny:

Yes, no, very much so. So as you might imagine, as we go through the preparation phase, we start to form a picture first and foremost about what the owner managers role, if indeed they’re involved day to day is, whether they’re a day a week or whether they are seven days a week, and what their key functions are. So are they customer facing? Are they heavily involved in product development? Are they performing a critical role that the will leave a gap if they exit the business? Because first and foremost, the buyers are going to be very keen to ensure the business is sustainable post transaction, and they will want to minimize risk. So if our founders are heavily involved, we need to understand what they’re heavily involved in. We also need to understand the strength of the next layer of management, the senior management team. What are their roles and functions? Has there been any discussions around succession planning? Is there an MD elect waiting in the senior management team that could step up to replace the founders? So that’s all a key part of what we’re investigating and understanding and creating a story around that so that we can really help the buyers understand what might be needed after the event to ensure sustainable business moving forward. If they’re one day a week and they have an ambassadorial role, there’s a very good chance. And the buyers have had the opportunity to meet some of the senior management team. There’s a very good chance our founder could be exited within two or three months, having provided a smooth transition. If they are six, seven days a week and hold seven out of the 10 key customer relationships, then there’s a very good chance that they’re going to be involved for one to two years after the event to make sure that those relationships are handed over, that the succession planning is enacted and the business is transitioned successfully.

Marc Harris:

I suppose the amount of time the management team has been in place, especially at senior members, is a good indication of their competence and commitment to the business. What happens if for whatever reason a company is not able to demonstrate that but everything else is right? You sometimes in a situation where you might bring someone in from the outside to fill those gaps and provide that continuity?

Andy Denny:

We have done that from time to time. When there has been a suitable candidate available and the owner manager was open-minded to allow somebody to come in and take more of a leading role within the business. So we have done that. I wouldn’t have said it’s something that we do every time. More often than not, we look to the senior management team to involve them, understand what they currently do, understand their strengths and present to the buyers where the gaps might be if the founder were to step back. If we can involve the management team in the discussions with the buyers early in the process, I find that’s incredibly helpful in getting buyers comfortable that the second tier of management is actually very strong and are capable of continuing to run the business moving forward. That might actually smooth the transition path for the founder as well. But you’re looking at length of service, looking at the age, looking at the background and experience of that senior management team either at the company or in previous roles, all helps to build that level of comfort for the buyer.

Marc Harris:

It’s the old adage, isn’t it, of people by people first and I suppose however much the transaction is based on numbers, people always play a significant element in the process.

Andy Denny:

I agree, people is absolutely critical. The financial is really important, but if the people fit isn’t there and the culture doesn’t appear to be right, then I think that’s going to heavily influence the seller’s decision as to which direction they might go in later in the process. So actually we find that when we’re sat down with buyers and we are sharing a management presentation, we are also very keen to in some ways interview the buyers. We need to understand what they intend to do with this business, how they operate, what their cultural values are and what they might bring to the business moving forward because that’s all critically important when a founder is making the ultimate decision on which party they might move forward with.

Marc Harris:

Earlier you spoke a little bit about the competition, creating competition and of course everybody understands that point, that things are only worth what anybody is prepared to pay for them and the more irons you have in the fire, the more competition that you’re able to create and the more options on your table. Can you explain to us more about how creating that competition works in practice?

Andy Denny:

Absolutely, so one of the reasons we spend so much time in preparation is that when we decide to engage with the market and start contacting parties, we want to know that all our ducks are in a row, that we are completely ready to engage and answer any questions that we will face in that process and the reason we want to do that is because once we engage with the market we want a very streamlined tightly run process that has clear deadlines at each step in the process as we engage with buyers. So we are very proactive in making sure that all of the buyers are contacted and we have either feedback as to why they don’t wish to look at the opportunity or more importantly a signed non-discosure agreement. That is the first step, we then send out an information memorandum which I mentioned earlier which describes the business and we give a tight timeline for first round indicative offers and we send out a process letter that explains the timing of the process and what we would expect to see from buyers in terms of detail in their indicative offers should they choose to make one but we don’t give price. As you rightly say that’s the one thing we don’t give guidance on, it’s up to the market to decide what the business is worth or each of the buyers to decide what that business is worth to them. Once we have those offers we will then be looking to schedule management presentations with our chosen few, those that are best representing in our clients mind a good strategic fit and have expressed a value and structure that is of interest to the client and we will go into a further round of discussions within a week or two week period with each of those buyers with a view to then inviting follow-up offers on the back of further information we have provided to every buyer and we do that in a very fair way, we make sure each buyer has had all of the same information and they’ve had access to the same individuals at the company and again we put a deadline in to make sure that the next round bids land when we would expect them to and if any further guidance is required on their offers we may we may provide that as well but the whole purpose is to keep the buyers on their toes in a short time frame very aware that they are in a competitive environment that there is a lot of appetite for the business that we are selling and that they really will need to put their best foot forward if they would like to be successful.

Marc Harris:

An obvious question I’ve got for you Andy is and this is perhaps a tad naive would each individual potential buyer be aware of the other individual potential buyers or is it more a question that everybody works with you in isolation and of course they’re aware that there are other interested parties?

Andy Denny:

Yes it’s the lesser of the former so we wouldn’t be disclosing which other parties we are talking to but we would make it very clear that they would probably have a reasonable understanding as to who we might be talking to and that there are most definitely other parties at the table but that as far as we would go.

Marc Harris:

Is there a typical amount of time typical number of years that a business will need to demonstrate that it has been trading for before a potential acquirer is likely to have the comfort that it’s a robust business it’s has been able so far to stand the course and it’s got a foreseeable future is there some sort of magic number?

Andy Denny:

Yes so if you’re talking about a full sale process as opposed to a round of funding or then I would suggest that buyers most buyers would like to see at least three years worth of trading history to get some level of comfort as to how the business is performing how they’re engaging with the customers whether they are keeping their customers over a period of time but very rarely do we find ourselves in a position where we’re representing a company that hasn’t had at least 10 years in service as it were and therefore has got a wealth of historic financial information that an analysis that will help support the robust nature of the business. Three to ten years not a long time when considering growing a company? Partly symptomatic as well of the fact that we typically only transact sell businesses sorry for values between 10 and 15 maybe 10 and 100 million of enterprise value so we wouldn’t tend to come across smaller businesses that possibly have only been trading for a short period of time because naturally it takes time to grow and scale to be in a position to sell at that value.

Marc Harris:

Other than a trade sale which everybody understands of course what are the common exit options exist for the owner?

Andy Denny:

Well we’ve talked touched on briefly private equity investment stroke management buyouts they can come in a number of different forms you can entertain a potential management buyout where there is no equity partner involved and maybe you’re utilizing capital within the business or bank funding and profits in the future to help support the purchase price but that could be a much longer period for the owners to wait for their total consideration for the sale of the shares. There could be a private equity backed MBO where the monies are more readily available in the transaction but typically a private equity deal for the founders especially if they are relatively involved in the business day to day the total proceeds must be considered over two transactions so a private equity investor will back the management team and the founder will potentially buy a majority stake in the business and the founder would continue with maybe 40-50% of the business moving forward support the private equity firm along with the management team to build that business over a three to five year period and then when the private equity firm is ready to exit along with the management then there would be another realization of value for the founders on that second sale it’s quite a journey they private equity are very successful at rapidly growing businesses bringing resource and expertise into the business and potentially providing capital for growth or follow-on acquisitions so the journey can be very exciting but there’s a lot of work involved and the risk goes up but as does the reward on the second transaction as you if the business is growing 50 to 100% on its bottom line then you can imagine the value creation that that could bring on a second sale but there’s a lot of work involved in getting there as well.

Marc Harris:

That extra value creation very tempting for the owner to want to stick around for an extra two or three years?

Andy Denny:

And it may be that the owner has built the business they’re in their mid-40s they’re still really hungry for what the next stage in the company’s growth has in store for them but they would like to take some money off the table maybe de-risk a little bit and bring in some expertise to help push the business on to the next level and in that situation a private equity transaction would be a really good opportunity for them providing they find the right partner.

Marc Harris:

Yes very attractive indeed how often does it happen that once being once having the benefit of the insight that you and your team are able to bring and once being exposed to more options than they perhaps thought were available in the beginning how often is it that along the way an owner might change their mind as to what exit strategy they want to pursue?

Andy Denny:

I mean absolutely we’re very keen to understand first and foremost coming into the room what were their objectives why are they entertaining a sale process now where is the business in its life you know in its journey what are the growth potential for the business moving forward but what is the seller actually trying to achieve do they want to land on a beach a few days after the deals happened or are they still really hungry have a real appetite forit but would like to take as I mentioned you know maybe take some capital off the table and bring in somebody with some expertise that can really help and push it to the next level so we’re exploring that very early on because that will inform who ends up on our research list as potential targets when we when we go to the market but yes we definitely talked through all of the options but they’re normally informed by what we are hearing the client is actually looking to achieve.

Marc Harris:

For those who are thinking about selling their business or certainly know that that is a that is a thought process that they’re going to be going through sooner or later realistically when should they formally begin that process and make contact with you?

Andy Denny:

Yeah I mean we would love to engage as early as possible because I think we can provide a biased perspective on key business decisions that are being taken maybe two or three years before a sale that could heavily influence the outcome of a sale maybe we could look at incentive plans for senior management maybe there is key performance indicator data that we can glean from the market and help shape within the business well ahead of actually going to market so that we’re presenting buyers in that market with a business that represents something that is exciting and interesting to them so that could be an area where we can help we can certainly look at assisting in filling gaps in the senior management team if we believe they are there or working with the founder to help them step back and allow the management team more time to get familiar with how the business operates and and do best some of his time and his well making him redundant so that that sale process is much smoother but we can also look at legal health checks so working with partner lawyers reviewing all of the documentation the contracts the employment agreements and many other housekeeping items in the background to make sure that they are of a standard and a level that would be expected of a buyer in a due diligence process so we’re streamlining and removing as many of the hurdles as we can nice and early giving greater certainty to the client that we will be able to transact when the time is right for much of that financial data.

Marc Harris:

Andy, that data that you require in order to do your jobs to the best of your ability would much of that not be available from the company’s accountant?

Andy Denny:

Essentially quite often it depends how involved the accountants are in the in the monthly reporting for example quite often we find the accountants come in at year end they collate and prepare the audit and yes they have an understanding of the accounts but on a monthly basis you know in terms of what’s reported in what nominal code and why they might not have that level of understanding it’s possible that we might if we were engaged early enough suggest that there’s an external interim FD or finance manager introduced to the company if we felt the financial reporting might not be of a standard that would get us through a process so that’s something that we will do if we feel it’s appropriate in certain circumstances other times we’re able to work with the trial balance data that comes directly from their monthly reporting systems and we can build up spreadsheets reconcile how the trial balance is connected to the management accounts and the management accounts reconcile to the statutory accounts and then we look at some of the sales analysis that’s available whether it be product sales by product or sales by customer and so on to build up a much bigger picture a better picture of where the company is really making its revenue and margin.

Marc Harris:

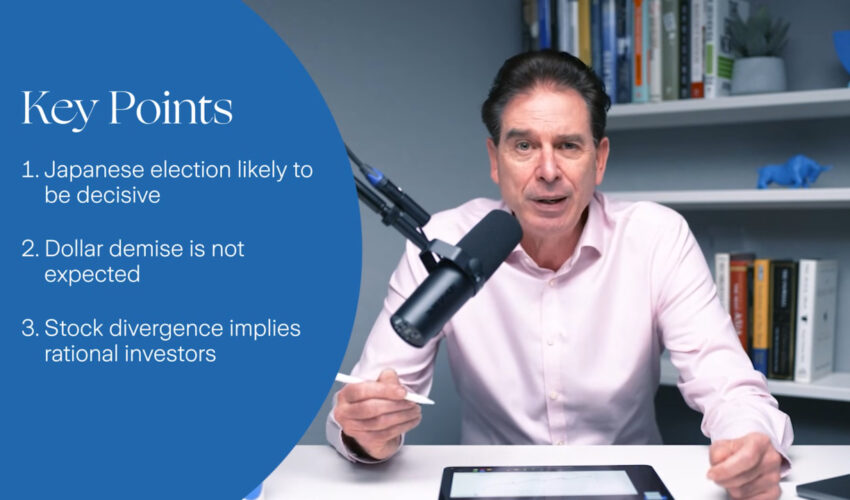

Fair enough you require more than just simply a profit and loss sheet at the end of the month or at the end of the year and the question I wanted to ask you and this is perhaps a bit unfair because I’m sure there’s not a good answer or not not in it not a straightforward answer to this question but I know everybody will want to want to want me to ask this is there any kind of data or consensus out there that points to the best time in a company’s life cycle to sell the business?

Andy Denny:

I think that’s really hard to say to be honest with you I’m not sure there’s a magic formula and there’s no AI code written for that one just yet I don’t think Mark but I think it I think just understanding I think it’s important to think about when the right time for the business is as opposed to when the right time for the founder is when entertaining a sales process so there is something to be said for that certainly and we would advocate that there should be some upside still on the table for the buyers at the point in which you’re going to market so if you’ve plateaued and you see two or three years more of relatively flat trading that’s probably not the time to be entertaining a sale process but if you are two years into a five-year growth plan or three years into a five-year growth plan maybe that is a better time to be entertaining a sale process because there’s still some upside there for the buyer and they can get comfortable that there is a growing business there that should continue to thrive after they bought it.

Marc Harris:

When it comes to trying to keep as confidential as possible the fact that the business is being sold obviously if you’ve got these it meets and greets taking place between management teams and potential acquirers that by definition lets the cat out of the bag so how do companies deal with letting key employees know that the business is en route for sale I mean is that generally seen as a negative thing a positive thing how is that handled because I suppose it’s very important to avoid a scenario where key employees are feeling uncertain about their futures and their enthusiasm and commitment to the business can be somewhat derailed and then suddenly flurry of CVs are going out because they’re hedging their bets looking for so how is that process managed because that must be that must be quite challenging?

Andy Denny:

quite right here it’s a hugely important part of the advice that we will work provide our clients on our guidance typically is to keep the group of those that are in the know as small as possible if we’ve agreed certainly in the preparation phase we would limit it to the founder potentially some of the senior management team to the extent that they are critical to the preparation and potentially critical to the presentation of the business beyond that we would encourage them not to involve anyone else and continue to run the businesses if they weren’t selling it because until we get further into the process there is no certainty that that we will sell and you’re right early on if you were to communicate to the wider team all you’ve got is all you give them is an opportunity to ask so many more questions there’s so much uncertainty at that stage of the process that you can’t really put their mind at ease so if you are to bring other members of the team in beyond the management team I would suggest you do so much later in the process when you can answer an awful lot more of their questions because that will put them at ease if it’s uncertainty and it’s risk then they are going to feel uncomfortable that the reality is though in my experience to date almost all of the transactions we have done the team have not been aware until we have signed the deal and the buyer is stood next to the seller in the room making the announcement in a very positive way that the transaction has happened that the people are critical to the business moving forward that the buyer is very keen to work with them believes they can open up greater career opportunities for the individuals to develop maybe open up new products and services new markets and that the future is bright and therefore that puts a lot of people at ease very very quickly so you give them the news but you give them the reassurance all in one go I think typically works very well and I most buyers that I have engaged with over the years would prefer to do it that way than bring too many of the team in early and I think it’s proven to work very well.

Marc Harris:

Does the employer often ask key members of the management team to whom they wish to make privy the sale of the business does the does the business own off and ask those employees to sign an NDA?

Andy Denny:

I’ve seen it done both ways I think more often than not actually it’s done on trust you know more often than not the senior management team have been with the founder for many a year and know the individual very well so I think more often than not it’s done on trust but I have seen a non-disclosures signed in certain circumstances with management and that’s to be honest a judgment call of the founder as to how well they know their management and how trustworthy they feel they are but as I say almost always it’s done on trust.

Marc Harris:

I mentioned in the introduction Andy that BCMS are unique in many ways completely impartial completely independent sell side only but there’s another quality that makes you very unique which is that you are the only UK corporate finance advisor who are employee owned. Can you tell us a little bit about what that what this structure means for you as a company I suppose culturally and indeed how that culture might end up percolating down to the experience that your clients have with you and I suppose that quite obviously you’re in a very very good position as a corporate finance advisor to advise company owners if they are thinking about taking their business down the the route of selling it into an employee ownership trust as you’ve done so yourselves.

Andy Denny:

So I’ll ask the last question first absolutely we are we’ve done it ourselves about 12 months ago we’ve learned the lessons and we can advise around what it takes to action an employee ownership trust and evaluate the the values of the clients that wish to achieve that and what it will help them achieve so most certainly we can advise there in terms of what it’s meant for us we we had already had an engaged committed motivated team with some you know strong shared values amongst the group already so we were well placed but it’s really taken us on another level as a leadership team we’re now able to be so much more transparent with the information we share we can engage with all of the employees as fellow owners to talk about the strategy new service lines that we might want to introduce and really consult and engage and take ideas and it’s created a real sharing atmosphere but also one where everyone is far more bought in they’re thinking like business owners so instead of potentially putting in an expense form or taking a day off when they’re you know particularly tricky in a transaction they’re now starting to think as owners as to what’s right for the company what’s right for the clients and that’s been really powerful for us and we’re thoroughly enjoying running alongside all of our team as as fellow owners.

Marc Harris:

I and we at Business TV indeed can personally attest to what you’ve just said we have found at every stage in our communications with BCMS everybody that we’ve dealt with your side has been just you know reachable helpful communicative engaged thoughtful it’s been a real pleasure and and I have no doubt that viewers who want to get in contact with Andy in this team you will I’m sure experience that same level of professionalism and contact as we have done and if you do want to get in contact with Andy in this team please look out for all of their details beneath this video as it has been playing on your screen we’ve got plenty of links through to BCMS’s website where you can learn more about what they do they’ve got lots of excellent customer testimonials on there from business owners who have gone through this process with them there’s forms to fill out you’ve got Andy’s contacts details there so so please use that information to learn more about BCMS and get in contact with Andy in his team and Andy thank you very much for joining us on Business TV and taking us through this topic.

Andy Denny:

Thanks a lot it’s been a pleasure Marc thank you very much for your time.

Please get in touch with Andy and BCMS using this contact form

Andy Denny

Director

Andy joined BCMS in 2002, and in that time has successfully advised shareholders on 50+ transactions with domestic and international trade acquirers across multiple verticals, including FMCG, construction services, software and SaaS, cosmetics, and engineering.

In addition, Andy has advised on several private equity-backed management buy-outs and growth capital transactions, with a focus on working with entrepreneurs operating businesses with enterprise values typically ranging from £10m to £50m.

As Director, he is also responsible for the BCMS client journey, and oversees and mentors the entire BCMS deal team, advising on preparation, go-to-market strategies, commercial negotiations, and due diligence.

BCMS is an employee-owned UK-based Corporate Finance advisor, providing private business owners with independent and impartial advice on their growth and exit strategies. We work with client businesses in a variety of sectors.

Interested to know what it is like to have BCMS in your corner? Former clients share their M&A experiences and offer advice and insights into the transaction process.

What should you look for in an M&A Advisor?

What is the most challenging part about selling a company?

What are the best things to do before you sell a business?

IT Services and software: Darren Cairns, Intrinsys

Click Here to view more than 20 BCMS video Case Studies