Making Tax Digital (MTD) for Income Tax is one of the biggest changes to the UK tax system in recent years – and it’s coming soon.

From April 2026, sole traders and landlords with business and property income above £50,000 will need to comply. From April 2027, the rules will extend to those earning above £30,000.

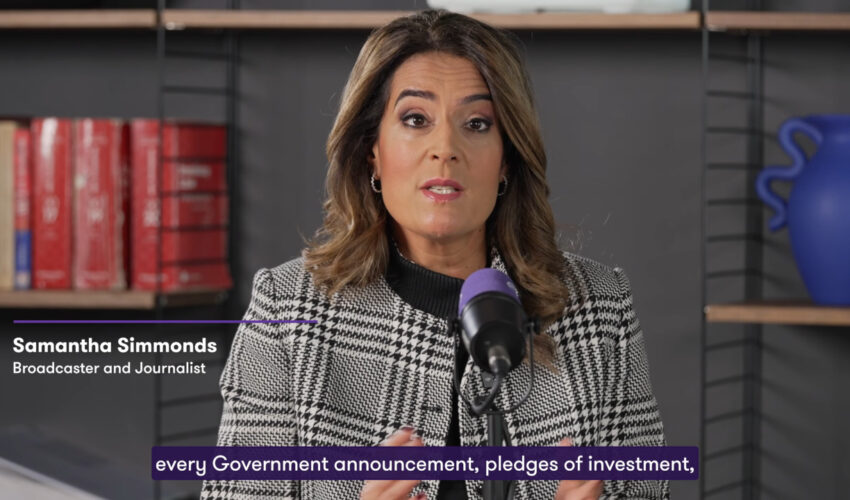

In this recording of our webinar on 14th October, we looked at:

– Exactly who is affected by Making Tax Digital for Income Tax.

– What steps you need to take now to get your business ready.

– The practical impact for sole traders, landlords, and small business owners. * How TaxAssist Accountants can support you with MTD-compliant software and advice.