Contact Moore Kingston Smith LLP

Description:

As the end of the tax year approaches, now is the ideal time to review your tax position and ensure you’re taking full advantage of the opportunities and reliefs available. Effective planning can help you avoid losing valuable allowances, improve cash flow, and stay aligned with your long term financial goals.

In this webinar, our experts outline the key allowance changes coming into effect and provide practical guidance on how to prepare proactively. We will also cover the latest developments in Making Tax Digital (MTD), and the steps you can take now to stay compliant and avoid disruption.

You’ll gain a clear understanding of what’s changing, what it means for you, and the actions you can take before year end to optimise your position.

Chapters:

Introduction

What income tax rates and allowances are changing from April 2026?

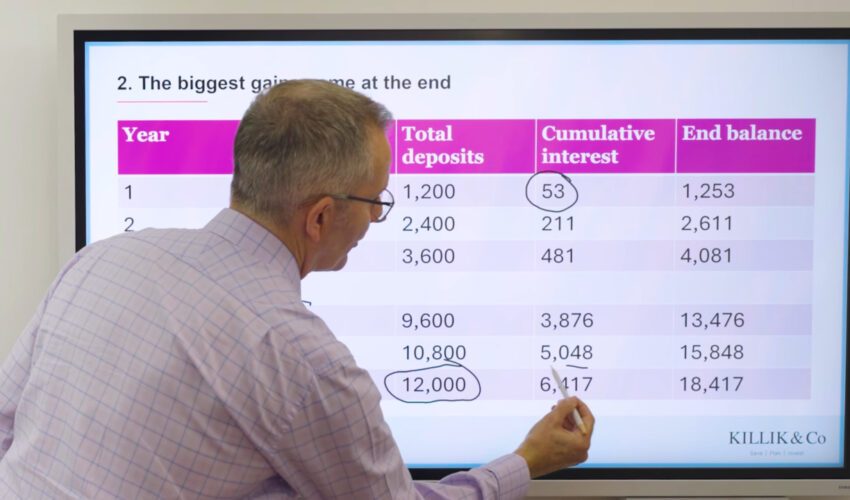

What allowances should we all be looking at to ensure we take advantage of everything on offer?

What has changed in relation to capital gains tax?

What can be done to mitigate the effect of the changing rates and allowances?

What if you’re thinking about selling your business?

What are you advising your clients on around inheritance tax?

Is it a good time to invest in EIS if there is no pension or ISA allowance left?

What changes have been announced for IHT which affects business owners?

Is there anything affected business owners can do to prepare for the IHT changes?

What about making tax digital?

From a property owner or landlord point of view, what would you advise people to look at?

What are the key takeaways to think about?