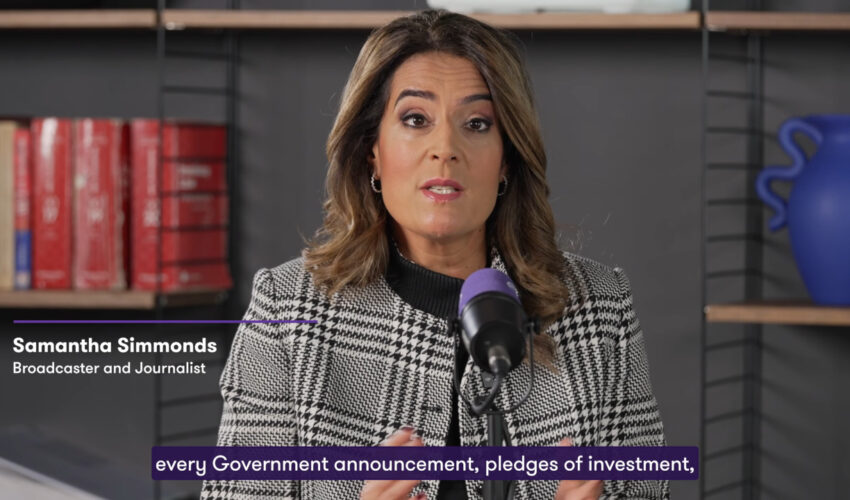

From April 2025, payroll costs have been rising.

Learn what’s changing, how it affects you and how to protect your business with smart planning.

Big payroll changes are coming for UK employers.

From 6th April 2025, the Employer NIC threshold dropped from £9,100 to £5,000 – and contribution rates rose from 13.8% to 15%.

That means higher employment costs, tighter margins and potential headaches for businesses of all sizes.

In this video, we explain:

The 2025 changes to Employer National Insurance Contributions (NICs)

How the Employment Allowance could offset your increased costs

The 2027 shift to mandatory payrolling of employee benefits (goodbye P11Ds!)

We’ll walk you through the impact step-by-step and show you what actions to take now to stay compliant, efficient and ahead of future rules.