Contact Moore Kingston Smith LLP

Description:

FRS 102 (the accounting standard used by many UK businesses) is having its biggest shake-up in years. The changes could affect your key financial metrics and have the potential to impact borrowing capacity if not managed correctly. The revised standard comes into effect for accounting periods beginning on or after 1 January 2026, leaving little time to prepare.

Our panel of experts discuss the changes and what they will mean for businesses going forward. They discuss:

The new requirements for revenue recognition.

The new on balance sheet model for accounting for leases.

Changes to disclosure requirements for small entities.

Other changes that may impact your business.

Your questions on what this means for your business.

Chapters:

Introduction

What is the FRS 102 and when are the changes coming into effect?

What are the new requirements for revenue recognition? The five-step model

Can you distinguish the date FRS 102 fully kicks in and the transitional provisions?

The changes on leases: who does it affect?

If the contract requires us to submit monthly applications for payment to the client for stage payments, can we continue to use the completion % method?

Can you give us some scenarios where clients need to be thinking about FRS 102?

Can the borrowing rate remain the same throughout the lease?

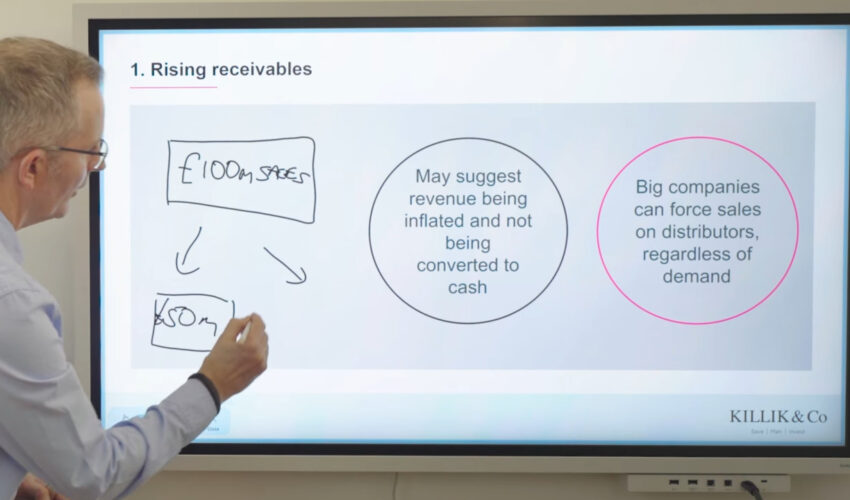

The more commercial impacts on financial statements of the revenue recognition

What are the changes to disclosure requirements for small entities?

Who are the key stakeholders that FDs should be managing?

Can we continue to recognise income based on time spent on client activities?

If a non-refundable training course, paid up front, is spread over six weeks, can it be taken as revenue at the start of the course?

How is turnover rent treated?

Are there any performer accounts out there with the new disclosure requirements within them?

Are there any other key points to note which may impact people listening today?