In the November budget just a few weeks ago we’ve seen a proposed major shifting of the goal posts; which is that starting in 2029 now only the first £2,000 of pension contributions made via salary sacrifice will be exempt from National Insurance (NI) for both employees and employers; and this is now likely to reshape how many businesses will have to structure pay, pensions, and the benefits they offer in the years ahead. I’m delighted to be joined by Damon Hopkins, Head of DC Workplace Savings from leading Pensions & Benefits Consultancy Broadstone, who is going to unpack what this all means: how salary sacrifice works, what’s changing and what savvy employers should be doing now to prepare.

Q01. We’d better start with the big news first, explain for us please exactly what this £2,000 cap means?

Q02. Does this fundamentally change the value of Salary Sacrifice, or is the headline more dramatic than the real-world effect?

Q03. Do employers really do have tax years 2026, 2027 and 2028 to continue benefiting under the current uncapped NI saving structure?

Q04. With another general election expected before 2029, what are the chances that a new government could change or even reverse the cap?

Q05. Given these proposed changes, what should employers be doing now?

Q06. How are your clients reacting?

Q07. Beyond those pension related strategies what else could employers do?

Q08. Having heard all these mitigation strategies what should employers look out for in terms of risks?

Q09. For anyone encountering this topic for the first time — How does Salary Sacrifice generate National Insurance savings for both parties?

Q10. Is salary sacrifice compatible with any type of workplace pension?

Q11. Are there rules governing how Employers must use the savingd they generate?

Q12. Is salary sacrifice normally implemented across the entire workforce, or selectively?

Q13. Is there a limit to how much an employee can sacrifice?

Q14. What are the situations where salary sacrifice is not appropriate?

Q15. At what stage is it best for a client to appoint Broadstone?

Q16. What does the ongoing relationship look like?

Q17. Can companies who might have got into difficultiy with their existing Salary Sacrifice schemes come to Broadstone for help?

Q18. From start to finish, how long might it typically take to formulate and implement an agreed plan and what do you need from your client ?

Salary Sacrifice for Pensions: Still a Powerful Tool But After the NI Changes Employers Need a New Game Plan

Salary Sacrifice for Pensions: Still a Powerful Tool But After the NI Changes

Employers Need a New Game Plan

*The text within this document has been auto-generated from the original recording and therefore may contain small inaccuracies.

Marc Harris: BusinessTV

Damon, nice to see you, thanks for joining us.

Damon Hopkins: Broadstone

Thank you for having me.

Marc Harris: BusinessTV

Pleasure, pleasure. I suppose we’d better put the cart before the horse, as it were, on this first question, because while we will be discussing exactly how salary sacrifice works, we’d better deal with the big news first, which is this £2,000 cap. So can you explain to us exactly what this is, please?

Damon Hopkins: Broadstone

Yes, it’s a great place to start and a really important point to clarify, Mark. So what is being proposed from April 2029 is not that pension salary sacrifice is in of itself being capped, but rather the NI relief that is achieved on pension salary sacrifice is being limited to £2,000.

So that doesn’t stop pension salary sacrifice being made above £2,000. All that it does is limit the amount of NI relief on the first £2,000 of pension salary sacrifice, and that’s a really important point. It’s one that’s been misunderstood by members from our experience, given what we’re hearing from pension savers, what we’re hearing from employers as well, as well as what’s being reported in the financial and mainstream media.

So it’s nuanced, but it’s really important because that doesn’t mean that people could or need to stop salary sacrificing above £2,000 per year. It simply means that the NI savings that are made are limited to the first £2,000. And indeed, there are some ancillary benefits of continuing salary sacrifice beyond the £2,000 limit.

Marc Harris: BusinessTV

What is your immediate assessment, Damon, of the likely impact upon UK businesses? I mean, leaving aside the misconceptions, one of which we’ve just dealt with, leaving aside those for the minute, does this, in its true sense, fundamentally really impact upon the value of this to employers and employees? Or is it another case that the headlines are more dramatic than the actual real world impact that it’s going to have?

Damon Hopkins: Broadstone

Yeah, look, I think the headlines are dramatic. They’re arguably sensationalist. Part of that is because it was so widely speculated and reported before the budget. Part of it is that pensions invariably are a political hot potato and politically sensitive. So I guess I can understand why perhaps there’s been the reaction, because it’s been so widely reported, as I say, in both mainstream and financial media. But I think the impact will vary quite significantly from employer to employer. Having said that, I think by the vast majority of employers and employees will continue to significantly benefit from salary sacrifice. Where there might be a disproportionate, if you like, impact on an employer is if they have a high proportion of high earners, perhaps in the professional services sector, certain employers will have a high proportion of high earners who also make high contributions and or make high contributions. So I suspect the vast majority of employers will see an impact, but a relatively modest impact. And indeed, therefore, salary sacrifice will still remain very effective and generate quite significant national insurance and savings for employers. But there will be employers who probably feel a disproportionate impact, either because they’ve got on average quite high earning staff and or they pay high contributions.

Marc Harris: BusinessTV

Another question I just wanted to ask concerning this cap and the impact of it and the recent news that we’ve had is that, of course, those people who would have followed the detail more closely than others will realise that this isn’t actually going to, these proposed changes won’t come into effect until 2029. So can you confirm those deadlines for us? Do employers really have there for theoretically three full years and a bit, 26, 27 and 28 to continue just to take advantage of this whole salary sacrifice for pensions under the current uncapped rules?

Damon Hopkins: Broadstone

It is entirely the case that nothing will change until April 2029. So it’s status quo. We’re expecting the legislation to be passed in summer of next year and then for the change to come in effect with effect from April 29. So yes, there’s obvious advantages. There’s the advantage of being able to make hay while the sun shines, so to maximise the benefits that salary sacrifice offers. But that sort of three and a half year timescale also gives employers a lot of time to plan and think about from the budgeting and otherwise perspectives what they can do about it. So it is helpful in terms of planning for a change like this, but it also means that nothing changes. So there’s still plenty of benefits to be had between now and April 29. And as I say, for the majority of employers, I think beyond 2029.

Marc Harris: BusinessTV

And then just indulge me one more question, keeping it within that vein then, if you would, is that if we have another general election before 2029, do you think that there’s any chance that all of this will be reversed? Or if one was really sceptical, perhaps one could think that this is all just a sort of super double bluff from the deep state to encourage people to make more pension savings, make hay while the sun shines, but then it’s all going to be reversed anyway. Or I mean, that’s perhaps an extreme example. But what would your take be on that? Maybe you don’t have any insight, any more insight than anybody else, but just interesting to hear your thoughts on that.

Damon Hopkins: Broadstone

Yes, the double bluff strategy would be an interesting one. And one that I’d love to give the government and politicians and the government credit for if indeed they were that astute. I suspect not. I suspect not. I suspect the effect will be that people do contribute more to, as we say, make hay while the sun shines while we can. So I think that will happen. That will be a consequence of the change, but I don’t think it would be by design. In terms of what the chances are that this doesn’t materialise or that it’s reversed, the timing is interesting. So the next election needs to take place before the summer of 2029. So the fact that this has been implemented in April 2029 does raise the prospect of some cynicism or scepticism, rather, as to whether it’ll actually materialise. Without getting into the politics of it, I think, of course, if there was a change of government, anything could change. So that is possible. I wouldn’t like to go as far as it being probable. However, if I was a business owner and certainly what I’m advising our clients at Broadstone is that, like anything in business, you’ve got to deal with what you know, and what we know is that this change is coming in April 2029. So I certainly wouldn’t take a strategy of wait and hope in the expectation or want that it might change because it may not, even under a change of government. So I would plan for the worst and make sure that you’re thinking now about A, what the impact is and B, what you can do about it.

Marc Harris: BusinessTV

Yeah, yeah. Unwise to bank on a complete reversal of that, of course, because, as we also discussed, I think, in one of our previous conversations, a new government coming in can obviously lay the blame on the previous government, yet enjoy the extra cash that they have coming in as a result of this being implemented, not for any fault of their own, of course.

Damon Hopkins: Broadstone

Indeed, if there’s an improvement in the fiscal situation, then perhaps they get a bit of room. If there’s not, you can say, well, look at what we’ve inherited, much like the current government is doing. Look what we’ve inherited and we’ve got to make some difficult decision or at least retain some difficult policy decisions that were made by previous governments. So yes, I think there’s lots to speculate, but part of prudence is to act in protecting yourself against the impact.

Marc Harris: BusinessTV

Indeed, indeed. And then, so then coming on to dealing in the real world, dealing with practicalities and certainties as opposed to speculation, and indeed, something that you sort of touched upon in an answer to previous questions, a couple of questions ago, was the fact that even though this isn’t happening until 2029, and let’s just all assume that it is happening exactly as it’s proposed to happen, you were about to sort of, I think, talk a little bit about the practical steps that companies should be taking now, even though it is three years away. So what do those look like with structuring, reviews? What sort of things should companies be doing starting right now and looking to achieve within the next 12 months, 18 months?

Damon Hopkins: Broadstone

Yes, so I think that’s probably twofold in terms of what a business or employer would be wanting to do. The first thing is I wouldn’t be complacent with the fact that this is three and a half years away, because some of those, some of the mitigation strategies may in and of themselves incur a small incremental cost. And the more time you leave yourself, the more you can amortise and manage that cost effectively. So my first bit of advice would be to act swiftly. Once you’ve convinced yourself that this is an important priority to get on top of, the first step would be to make an impact assessment. We discussed earlier that I think there’ll be quite significant variability in the impact on employers, the extent to which they’ve got higher earners or higher contribution rates that mean this cap bites or has a detrimental impact. So I think an impact assessment is really important because you may decide actually the impact is tiny or you may establish that the impact is really small and there’s very little for you to have to do. That’s step number one and a really important one, I think, in the next few weeks or months. So understand the real world financial impact of the changes, step number one. And then step number two is thinking about what mitigation strategies you might want to adopt. There’s some obvious ones that we’ve alluded to already. So making hay while the sun shines, encouraging employees to make contributions over and above their current levels, if indeed the national insurance savings will be mitigated beyond 2029. Thinking about, if you don’t already do, offering bonus sacrifice. So again, that’s additional earnings that can be sacrificed in lieu of pension contributions. The other strategies that I think employers are likely to consider is currently under the automatic enrolment legislation or requirements, employers need to make a minimum employer contribution. And generally speaking, that means that by and large employers are making contributions. So if hypothetically an employer is making 5% contribution and an employee is making a 3% contribution, I can see some employers considering whether to change the proportion of employee contributions to employer contributions in incremental steps, such that by the time April 29 arrives, the NI savings which you get from employer or the NI relief rather that you get from employer contributions is maintained. So in that example, perhaps an employer decides to move 1% per year from employee contribution to the employer contribution, because they’ve still got to get to an aggregate minimum level of contribution under automatic enrolment requirements, but effectively creating the same national insurance saving by shifting employee contributions to employer contributions. Of course, that comes at a cost and therefore that cost needs to be carefully considered and ultimately funded. But again, to my earlier point, if you’re giving yourself three and a half years, you can A, do that in increments and amortise the pain, but there are other ways that perhaps you could fund that through your budgeting process that would be helpful with a period of time to consider those sorts of strategies.

Marc Harris: BusinessTV

How are Broadstone’s clients reacting? We’re having this conversation only two weeks after the 26th of November. So how are Broadstone clients reacting and are your client employers looking to communicate what they’re up to, their strategies to the employees? Or at the moment, is it this is just very much something that employers are looking at and they’re just continuing on as they would do under the normal regime?

Damon Hopkins: Broadstone

Yes, so I mean, I guess, as you say, we’re a few weeks on from the budget. I always said when the budget date was announced, I’m not sure its proximity to Christmas helps, I’m not sure it helps economic sentiment in the lead up to an important part of the year for the economy, et cetera. But it also means that, frankly, what was ultimately announced was the less bad of the speculated scenario. So firstly, I think there was a little bit of a sigh of relief when they heard about the change. I don’t think the change was necessarily welcomed. But in terms of the range of changes that were speculated, this was certainly on the less bad end of the spectrum. So I would firstly say that employers aren’t panicking, certainly not in so far as our clients are concerned. We’ve actively communicated that we will look to understand the impact and mitigation strategies with them in due course, once we’ve got formal views on the extent of impact for each of our clients. But communication is a really important one for no other reason that this was widely publicised as a possible change. As I say, it was often misreported and therefore clarifying exactly what the change means is definitely a priority for a lot of our clients because there’s been a lot of questions, a lot of those questions misfounded in what they’ve read in the media, et cetera. So employee communication, certainly where employers have got a sense that this will have an impact is a really important one that I think employers, if you instinctively think this is going to have an impact, is an action to prioritise early on in the process. Even if it’s just a holding statement to clarify, here’s the objective facts of what’s changing, much like we’ve discussed now, and the business is working through A, what the impact is, and B, how we do our best to support employees and the business through managing those impacts between now and 2029. So something of a holding statement to say, don’t panic, we’re looking at this, and we’ll revert with any future changes that the business proposes as a result of what’s coming in April, 2029. But communication, when it comes to all things pensions, effective and timely communication is always really helpful.

Marc Harris: BusinessTV

What about other things beyond just pension-related strategies? Could employers be thinking about doing or mitigation strategies? Because it doesn’t just have to focus around pensions, does it?

Damon Hopkins: Broadstone

Yeah, absolutely. And look, the first starting point, as we would often open these sorts of conversations up with our clients, is it’s not just about pension cost or the impact from a pensions perspective. Pensions are part of your broader reward, benefits and compensation strategy, and your people strategy. So looking to understand the impact’s really important, but looking to mitigate that impact extends well beyond pensions or indeed benefits. It’s to pay, it’s to bonuses, et cetera. And it’s how you, within your budgeting over the next three years and your strategic objectives over the next three years, incorporate this as part of that overall planning and strategy. So that’s the first point I would make is it’s more than just pensions, it’s even more than just benefits. But there are some low-hanging fruits as well. So one of the other speculated changes, which we were reasonably convinced would happen, was that there would be some sort of restriction or some sort of cap on other employee benefits that are currently allowed to be offered via salary exchange. Some of those, what one would argue, are probably very generous or more generous than they need to be and would politically be far less sensitive and changing than, for example, pensions. So two good examples are cycle-to-work schemes or electric vehicle schemes, which can be offered via salary exchange. Those were completely unchanged in the budget. So maximising benefit offering via salary sacrifice would be one strategy I would suggest employers consider. And the benefits are clearly twofold. There’s the national insurance saving derived from any benefit that’s salary sacrificed. But you also look like a good employer offering additional voluntary benefits to employees like cycle-to-work, like electric vehicle, like tech.

So none of those things, which we were a little bit surprised by, were impacted by this. This cap on national insurance savings is only applicable to pension salary sacrifice. So those other benefits still remain very valued by employees, but can be pretty cost effective and achieve NI savings via salary sacrifice as well.

Marc Harris: BusinessTV

Yeah. Now, and it’s interesting you mentioned the cycle-to-work scheme because, I mean, maybe I’m just getting old, but when I think of the cost of a bicycle, I’ve got a few hundred pounds in my mind. But of course, that’s not the case anymore, is it? So many bicycle purchases are well in the thousands. So yes, it is interesting that those benefits have been completely untouched.

Damon Hopkins: Broadstone

Well, and I don’t want to be too cynical, but I think it’s universally known that not all those bicycles, in fact, probably very few of them these days are actually bought to cycle-to-work.

Marc Harris: BusinessTV

Right.

Damon Hopkins: Broadstone

Post-COVID, given the amount of time that we now spend in the office, I was pretty astounded that wasn’t changed because people tend to use it for buying bicycles, of course, and I’m sure there’s the benefits of healthy living, et cetera. But I think very few these days are actually used as a mode of transport to the office, which is what the intention was.

Marc Harris: BusinessTV

Yeah, super high grade, £12,000 worth of triathlon bike is not being used to cycle-to-work and then bundled in the store when you get there.

Damon Hopkins: Broadstone

Quite, yeah.

Marc Harris: BusinessTV

That’s interesting. Of course, it’s easy, or something that companies, of course, want to avoid is taking sort of knee-jerk responses and then quickly running around to look at different strategies that they can employ. Not that that’s a bad thing in itself because they will need to do that with expert help from yourselves, of course, but what are some of the, in response to implementing mitigation strategies and looking elsewhere at what can be done, what are some of the risks, some of the pitfalls, perhaps, that companies should be cognisant of?

Damon Hopkins: Broadstone

So I think the risks are predominantly those risks associated with offering a salary sacrifice arrangement in the normal course, ignoring the change that’s going to happen in April 2029. So firstly, this is actually not a tax or necessarily even a pensions issue. This is an employment issue where an employee and employer contractually agree to reduce their salary in lieu of another benefit. So it’s making sure that whatever strategies you implement to manage and mitigate the impact of this change in future is contractually permissible and understanding what of any changes you might need to make to your contractual wording going forward. So again, that is a normal course of implementing and managing a salary sacrifice arrangement is always an important point. And the second one that I’ve mentioned that is always very important is ensuring particularly over the next three years where people look to maximise the amount that they sacrifice from a pensions perspective is ensuring that they don’t sacrifice salary below the minimum wage level. So that again is an ongoing risk for operating any salary sacrifice arrangement. I think it becomes more acute because there is no doubt that some employees will look to maximise their contributions over the next three and a half years or so. But yeah, look, it comes down to the usual risks associated with running a salary sacrifice arrangement which are important but very manageable with the right support, the right advice and the right processes behind running these arrangements.

Marc Harris: BusinessTV

Perhaps now would be a good time for me to ask you if we might now just to sort of take a step back and think about maybe somebody who’s coming to this topic for the first time. Can you, now that we’ve sort of dealt with the cap and what we think is going to happen and things that companies can do in order to mitigate the impact of it, can we sort of just ask you to unpack the basics of what salary sacrifice and as it relates to people salary sacrificing to make pension contributions and therefore reduce NI. Can you sort of just take us through what those basic advantages are for both the employee and the employer?

Damon Hopkins: Broadstone

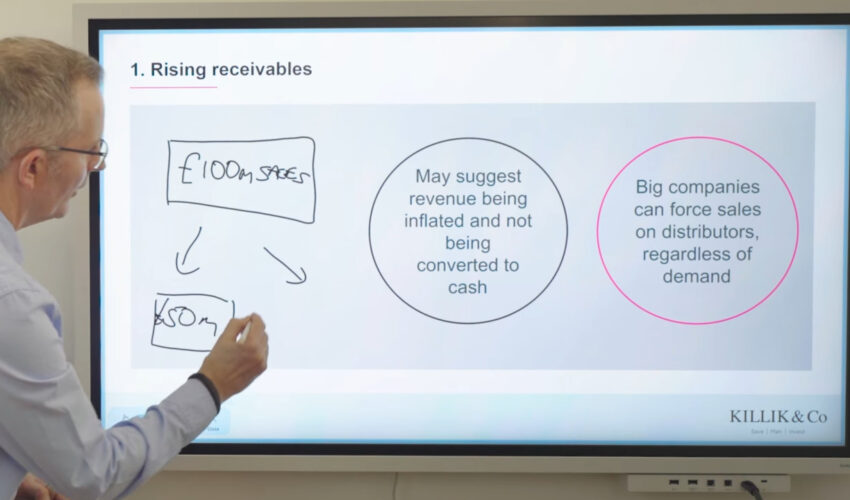

Sure, so the first overarching statement I’ll make is that, or reiterate, is that I’m absolutely clear that for the vast majority of employers, salary sacrifice arrangements will continue to be an effective way of saving national insurance beyond 2029. So if you’re considering or contemplating it, I certainly wouldn’t let the announcement, the budget announcement, curtail that. It needs to be incorporated into the feasibility and analysis of the implementation, but I certainly wouldn’t let that discourage you from considering it because it will continue to be effective. And again, it is quite nuanced and therefore perhaps potentially my vague question about the impact of this change. It’s going to vary significantly from employer to employer and indeed at employee level, depending on the amounts of contributions they pay and depending on, you know, their salary levels. So, you know, those are just overarching couple of points to make. In explaining how salary sacrifice works, the starting point is to remind everyone that employers do not pay national insurance on pension contributions that they make on behalf of their employees. So typically an employee pays a contribution, an employer pays a contribution, employer pension contributions don’t incur national insurance. So that’s an important point in the context of what national, of what salary sacrifice achieves. So salary sacrifice, or indeed pension salary sacrifice, involves the employee agreeing contractually with his or her employer to reduce their salary by the equivalent amount of their employee contribution in lieu of the employer paying that employee contribution as an employer contribution. And the benefits of that are that the employer doesn’t pay any national insurance on those contributions that otherwise would have incurred national insurance as part of, as part of the employee’s pay. And because the employee is reducing their gross pay, they also reduce the income tax and national insurance they would pay on that, on that, on those earnings. There is an additional practical benefit in that some contributions, sorry, contributions paid to some types of pension schemes require higher and additional rate taxpayers to claim the tax relief available on pension contributions back from HMRC via the self-assessment process. Because you are paying, reducing your, your salary by the amount of those contributions, you’re not paying income tax and national insurance on them in the first place, and therefore it removes the need to claim that tax relief back from HMRC. Just an additional benefit for an employee who are, who are contributing to certain types of pension schemes where that is required. But ultimately the main benefits are that both the employee save, the employee saves on income tax and national insurance by virtue of their, their salary being reduced by the equivalent employee pension contribution, and the employer makes national insurance savings on that contribution by virtue of it being paid as an employer contribution.

Marc Harris: BusinessTV

Is salary exchange appropriate to any or, and all types of workplace pension schemes?

Damon Hopkins: Broadstone

Yes, absolutely. So as long as the pension scheme is HMRC approved, you can, you can make contributions via, via salary sacrifice. Fundamentally that comes down to the fact that this isn’t technically, it’s not a pensions issue, nor is it really a tax issue. It’s a, you know, it’s a, it’s a maximising of the NIR relief that’s available on, on employer pension contributions and therefore exchanging one type of contribution for another. But yes, it is, it is ultimately the pension scheme is just receiving a sum of money that otherwise would have been employee contributions. It’s just being paid as an employer contribution. So there’s not really any discernible difference in how a provider would review that other than, or receive that other than the fact that it’s an employer contribution, as opposed to an employee contribution which is achieved by virtue of the salary exchange mechanism. So yes, any approved pensions, HMRC approved pension scheme should be able to, to, to receive contributions via pension salary exchange.

Marc Harris: BusinessTV

Are there rules that govern what the employer must do with that extra cash that they have now that otherwise they wouldn’t, or are they free to just do whatever they want with that money, reinvest it in the business, take it out of the business, do whatever they want with it?

Damon Hopkins: Broadstone

It’s the latter. So there’s no rules whatsoever that prescribes that the employer has to do anything in particular with, with those national insurance savings. By and large, most employers tend to retain them and either use them towards other benefits or, you know, other, other budgetary requirements that the business might have in its day-to-day operations. That tends to be, you know, a reasonable majority of employers according to, to, to our research. But there are a reasonable minority of employers that either pass on in full or part that saving in some way, shape, or form. So some might, you know, use it to fund additional benefits that they offer employees, they may just enhance the employer contribution by whatever saving they’re making. So it’s not unusual for the employer in some way, shape, or form to share that with employees, but the majority of employers tend to retain the saving.

Marc Harris: BusinessTV

When employers, along with their, with their employee base decide that this is a route to go down, is then that something that must be implemented blank, in a blanket format across all of the employees, or is it sometimes offered selectively? Or if it’s offered to everybody, do then some employees decide, no, I don’t want to do that for whatever reason? How does, how does that work? Or, and what, you know, from what are the, what are the legalities and what do you see companies doing?

Damon Hopkins: Broadstone

Yeah, so generally there’s two ways of doing it, either opt-in, so you just give the employee the choice of, of joining, or opt-out, which generally is on a sort of negative affirmation basis. This is the way you’re doing it, this is the way we’re doing it, this is our default approach to paying pension contributions, it kind of, this is what we’re doing, tick this box if you want to opt-out sort of thing. So there’s the opt-out, which, you know, which is a, a more universal blanket approach, and there’s the opt-in, which is you’re relying on employees to actually actively decide that they want to, to pay their pension contributions by salary exchange. By probably some significant margin, the vast majority of employers tend to do it on an opt-out basis, which ensures that the take-up, which is usually in the high 90 percent, is much higher than those opting in. I’ve got one client of mine in particular that uses that opt-in approach, and they tend to have, you know, from one year to the next, 40 to 50 percent of employees participating. Opt-out, you tend to get, as I say, in the high 90s. So it’s two different approaches, but, you know, the opt-out approach that is, you know, the kind of default, this is the way we’re going to do it, unless you opt-out, is, is more, it is far more prevalent.

Marc Harris: BusinessTV

Okay, okay, and from an administrative point of view, probably a lot easier as well. Now, my next question, and it’s, it should be straightforward, but in view of this cap, people are going to get confused about the next question that I ask you, so we might sort of need to explain it quite clearly. Is there a limit to how much an employee can, how much of their salary they can exchange in return for benefits?

Damon Hopkins: Broadstone

Generally, no. With, in the pensions context, two, two important points that I’d make. The first is that the, the HMRC has something called an annual allowance, which is, sounds quite positive, but in fact, it’s a restriction on the amount of tax-efficient savings you can make into a pension scheme. So, you know, if you, if you, if you salary exchange and therefore contributed so much that you exceeded that allowance, which is currently £60,000 per tax year, and you, you would then cease to receive the tax relief above contributions, or contributions above the £60,000 threshold, so it’s not saying you, you can’t, it just means that you’ll, you’ll, you’ll cease to, to receive tax relief. So, it’s not a, it’s not a limit per se, but it’s a, it’s a kind of restriction that you’ve got to be aware of as a taxpayer. And the other thing, which is one that we’ve mentioned already, you can’t sacrifice your earnings below the minimum wage levels. So, that’s an important, certainly from an employer’s perspective, is probably the single biggest risk that they need to be, they need to, they need to be aware of. But yes, and then of course, we come back to what will happen in April 29, which will simply mean again, that it doesn’t stop you from contributing above the £2,000, you will simply only receive NI relief on the first £2,000.

Marc Harris: BusinessTV

Yes, and again, a very important distinction to make, isn’t it? Because those people who perhaps are coming toward an end of their working career, who don’t feel that they’ve gotten up in the pension pot, don’t be confused, this is not an hour, no longer allowing you to contribute that maximum. If you were able to do so, you can still contribute as much, almost as much, you know, within reason with up to that £60,000 limit to your pension, as you would like to. Cap is a different, is a different thing. You mentioned just quickly there, the obviously scenarios that people must be aware that they, they don’t get themselves into, which is sacrificing to a level which then puts you below the minimum wage. And of course, obviously, that’s implications for the employee and the employer, of course. Are there other situations, circumstances when salary sacrifice isn’t appropriate or other risks that, again, companies need to be thinking about when they’re thinking about this in general, as a general strategy, as a general plan?

Damon Hopkins: Broadstone

Yeah, you know, there are, there are some knock-on effects to other benefits, so particularly earnings-related benefits like group life assurance or income protection. So if you’re reducing someone’s salary, naturally, that could have an impact on the level of insurance that you’re buying for that or funding for that employee. But generally speaking, there is a way of ensuring that pre-salary sacrificed or salary exchanged salary to maintain those benefits. So that’s one thing to be aware of. But again, very, very manageable. And as I say, the way it tends to work is that you ensure the pre-salary exchange salary, not the reduced salary. And then from a kind of, again, from an individual employee perspective, things like credits or mortgage applications, which rely on earnings, could be impacted as well. But generally speaking, what if, for example, on your pay slip, it’s showing that your gross salary is reduced by virtue of salary exchange, most employers would just, again, write to, write a letter to a credit provider, confirming their pre-salary exchange salary and setting out the reasons why the pay slip may reflect, not be entirely reflective of their gross salary. So yeah, there’s a few, these are fairly small, easily surmountable things that you need to think about as part of the implementation, ongoing running of the salary sacrifice arrangement.

Marc Harris: BusinessTV

When is the best time for Broadstone to start working with a company? Is it once that company’s already decided that this is what they want to do, and now they just want to help implementing it? Or is it perhaps a lot earlier in the process when they’re needing to assess whether it’s right for them in the first place? I guess it’s kind of the former, but perhaps you can sort of speak about typically when you get engaged normally by a company.

Damon Hopkins: Broadstone

We tend to get engaged at feasibility points. So if we were to do this, what would the cost of implementation be versus the savings? So it really is that feasibility assessment that we would get involved with. And certainly I would recommend that that’s the approach to take, because then we can support through the design of the arrangement, the implementation, how it’s operated, mitigating the various risks that we’ve spoken about, all the way through to employee communication. And frankly, implementing salary exchange is not particularly costly in terms of the advice and support that’s needed from Broadstone. I guess I can speak on behalf of Broadstone. So by and large, it tends to be feasible for the vast majority of employers, and I suspect that will continue to be the case even beyond April 2029. But as early on in the process is always helpful, because we can guide employers through not just the design, but making sure the design protects against all the risks that we’ve spoken about, supports the employee communication in a way that it’s a welcomed benefit for both employer and employee. And I would say, just to give you a sense of the kind of economics that we’re talking about.

Marc Harris: BusinessTV

Yeah, please do.

Damon Hopkins: Broadstone

I would say 95 out of 100 salary, pension salary exchange projects that we undertake, achieve a year one saving of the cost of implementation versus the NI saving. So, you know, even even if you’re sort of thinking about it in the context of what might change in April 2029, the reality is most employers have still got three years of the savings at current level. And then indeed, even beyond that, I suspect it to be a viable and effective strategy for saving national insurance.

Marc Harris: BusinessTV

Already a positive saving in year one is for 95% of clients is really quite quite impressive. And then what what is what is the ongoing relationship looking like to do? Is it is it the case that once a system, a salary exchange system like this has been implemented, it’s all sort of plug and play accounting software takes care of everything? Or do you need does it does a client need to get you in at some point during the next year, just to make sure everything’s running properly? Or do you just take a backseat and they give you a bell if they get me into trouble?

Damon Hopkins: Broadstone

It’s the latter. So it’s very, it’s very much one and done. So once it’s all set up, okay, payroll providers of all major payroll providers are very accustomed to to salary exchange across multiple benefits. Once it’s all set up from a payroll perspective, it becomes very, very simple, and doesn’t need much monitoring or involvement from from a consultant like ourselves. So very much one and done implementation project with very little monitoring. Again, it comes back to those risks, the key risk of being monitoring your your minimum wage levels. But again, payroll providers tend to programme payroll systems to ensure that that doesn’t happen. So yeah, very straightforward project to begin with, with very little ongoing monitoring, and, you know, involvement of support, you know, on a kind of year in year out basis.

Marc Harris: BusinessTV

Well, that’s good to know. But probably something I should also mention, and I’m assuming that this is the case, but while you go in and do make all the assessments and the implementation, and as you said, it’s a sort of go in there, and it’s a one and done deal. And then afterwards, it all runs smoothly. Companies who have got themselves in a mess probably shouldn’t feel embarrassed about making contact with you if they do need your professional help to sort everything out if it has gone wrong, because there might be some companies I mean, and I guess that probably happens from time to time, maybe you pick up clients, because people have businesses have been trying to do this themselves, and they’ve got themselves in a mess. And that mess has only now been amplified by the proposed rules changes. I mean, do you do that? Does that happen to you? I guess it does.

Damon Hopkins: Broadstone

It does, from time to time. And salary sacrifice has been around for a long time. I think auto enrolment has amplified the complexity of pension contributions, having to pay a certain minimum levels that legislation requires, as well as that within the salary exchange environment means that it is more complex, and therefore things do go wrong from time to time. So we are, you know, we are sometimes called in to do a sort of full cradle to grave audit of pension contribution payments over a number of years and having to make, you know, do some rectification exercises. But the reality is, if you’ve got any nervousness about compliance, a lot of those auto enrolments or salary exchange requirements that the longer you leave that audit, the bigger the problem becomes. So, you know, again, naturally nipping it in the bud and ensuring that you understand any issues and resolve them quickly is helpful. But yes, from time to time, we do, we do get involved. Fortunately, I can’t think of any of our own clients where that’s happened, but you’re quite right, others that perhaps tried to do it themselves, and it’s gone wrong, have called us in halfway through to kind of do a bit of a clean up in an audit.

Marc Harris: BusinessTV

Yeah, a lot of, a lot of owner directors are very sort of fond of a DIY approach whenever they can, whenever they can. No, that’s it. It’s just, I thought I would ask that question. And then assuming that that hasn’t happened, and you are working with a client from the beginning, going in, you’re meeting up with them, you’re discussing, you’re helping them assess, you know, who in their workforce this is appropriate for, looking at the employee landscape, implementing the strategies. What sort of timeframe are we looking at from start? I mean, obviously, that’s a difficult question, because it depends on the company, the employee base, how many employees they’ve got, lots of factors, I’m sure. But in general, are you able to sort of approximate roughly how long that process takes? And what sort of input and commitment you need from senior management? What sort of details and digital collateral you need from them in order for you guys to be able to do your job?

Damon Hopkins: Broadstone

Yeah, I mean, employee data is usually the starting point, because that’s what we need for the feasibility exercise. So right, the cost of implementation is x, versus the NIH savings is y, the return on investment is z. So that’s an important requirement. We would probably need HR support in terms of some of the communication, we’d need to ensure the payroll provider configures things from their perspective. So there are some dependencies around resourcing from other providers and implementing salary sacrifice. But in the best case scenario, I’ve seen them implemented in as little as two months. But on average, it’s probably somewhere between four and six months for a medium to large size employer. Generally speaking, the more employees, the slightly longer it will take the process of the process, though, we follow the same steps, whether you’re, you know, two, two employees or 2000 employees. But yeah, I think a few months tends to be the general timescale for implementation.

Marc Harris: BusinessTV

Okay, well, and important, of course, when we’re dealing with employee salaries, I’m sure there’s lots of checks and balances along the way, aren’t there? Because it’s important, it’s really it’s, it’s critical that it’s got right first time, because of course, the last thing you want is a disgruntled employee base who aren’t getting paid what they thought they were, or it hasn’t been communicated properly as to exactly what is going on.

Damon Hopkins: Broadstone

And to reiterate, this is a contractual change between employee and employer. And therefore having the mechanism to affect that contract change. We’re not generally speaking, we don’t go in and issue a whole new contract of employment to give effect salary exchange. It’s usually in a, in a sort of a very simple one page, but robust form. But making sure that mechanism is effective to make that changes is a important part of the process and be needs to be legally sound. And both employee and employer need to be comfortable with the way that that’s worded and ultimately delivered.

Marc Harris: BusinessTV

Yeah, indeed. Well, viewers, please get in contact with Damon and his team. Clearly, you’re in safe hands, whether you’re coming to him because you have already tried to do this yourself and now need help, or indeed, whether you’re thinking of investigating this whole arena for the first time. So please look at all the information that we have beneath this video as it’s played on your screen. There’s loads of links through to Broadstone’s website. There’s contact forms that you can use to fill out and reach Damon and his team. So please check all of that out and do what you can to investigate the topic for yourself and reach out to Damon and his team. Damon, all that remains for me to do is thank you. Thank you so much for taking the time to join us discussing what is quite a nuanced topic. Very shortly after all of this news has dropped after the budget. So thank you very much. We really appreciate you giving up your time and spending it with us today on Business TV. Thanks a lot.

Damon Hopkins: Broadstone

Mark, thank you very much. Great discussion and appreciate the opportunity.

Marc Harris: BusinessTV

Pleasure. Our pleasure.

Please get in touch with Damon and his team using this form

Damon Hopkins

Head of Head of DC Workplace Savings

Broadstone

I have advised trustees and corporates across the full spectrum of DC for 20 years and now lead the DC business at Broadstone. If you’d like to discuss anything DC, please do get in touch.

Broadstone is a leading, independent, UK consultancy delivering expert advice to employers, insurers and pension scheme trustees.

For over 40 years, Broadstone has been providing its clients with a wide range of specialist services including employee benefits consulting, pensions administration and actuarial services, investment consulting, insurance consulting across life, non-life and the Lloyds and London markets, credit risk services and a range of financial modelling and data analytics services. Broadstone is also a recognised leader in their redress calculation services.

Broadstone’s team of over 650 expert consultants and administrators, including more than 85 actuaries across ten UK offices, empowers its clients to navigate complexity and change confidently with, clarity, leadership and purpose, all delivered on a platform of exceptional service.

Click on the images below to learn more about Broadstone’s Employer solutions

Offering a workplace pension is not only a legal requirement, it’s one of the most effective ways of helping your employees save for their future.

Employee protection plans provide lump sum payments or ongoing financial support in the event of long-term sickness absence, the diagnosis of a critical illness or the loss of life.

Download Broadstone’s Employee Benefits Survey Summary

“The mass transition to hybrid working, a cost-of-living crisis, a public healthcare system on its knees and a national shortage of healthy, productive employees are all the result of unprecedent events such as the Covid-19 pandemic, wars on multiple fronts and increasing geopolitical tensions. It’s fair to say that more has changed in the last 3-4 years than over any comparable period in the living memory of most of today’s workforce.”

Damon Hopkins – Head of DC

Brett Hill – Head of Risk & Health

Pensions in 10 – two recent episodes from Broadstone’s excellent podcast series

David Brooks is joined by Sadhbh Lynch to dive into the latest pensions hot topics

David Brooks is joined by Andrew Knight-Stephens for a lightning-fast roundup

Click here for more episodes of Pensions in 10