If you’ve ever changed jobs, chances are you’ve collected a few different pension pots along the way. Did you know bringing them together is easy and could save you money and time in the long term?

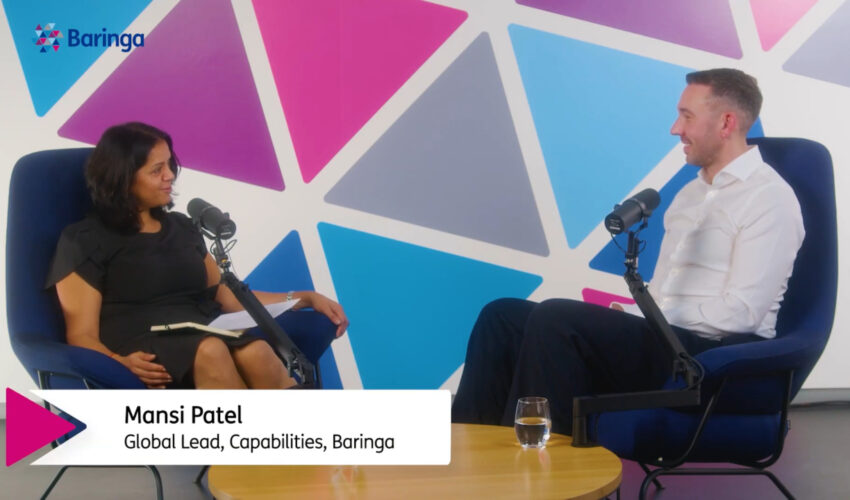

In this episode, our host Iona Bain is joined by Mike Crossley, Head of Workplace Pension Consolidation at L&G, to demystify the process of consolidation.

Together, they tackle the big questions: How easy is it to do? Could lower fees and clearer tracking of your savings make it worthwhile? How do you know if this is the best thing for you to do? Do you need an expert to help?

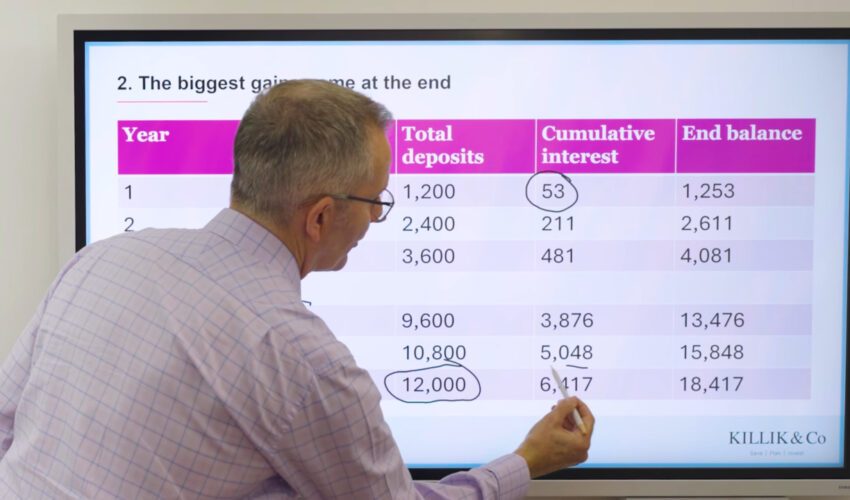

Mike explains how pension transfers work (often faster and simpler than you might think), the potential long-term benefits, and the key safeguards designed to protect savers.

Whether you’ve got £200 or £200,000 saved, this episode will help you take control of your retirement planning and maybe reduce your future life admin too.

Capital at risk, pension consolidation isn’t always the right choice as your old pension might have valuable features or benefits. Always get advice if you are unsure.

Iona and her guests share their own personal thoughts and opinions in this podcast. These might be different from L&G’s take on things. They give financial guidance for a UK audience that’s relevant at the time of recording. It’s general best practice, not the kind of personalised advice you’d get from a financial adviser.

Video chapters:

Introduction

Why multiple pension pots?

Consolidation process

Pension pot sizes

Finding lost pots

Pensions dashboard

Introduction

Why multiple pension pots?

Consolidation process

Pension pot sizes

Finding lost pots

Pensions dashboard