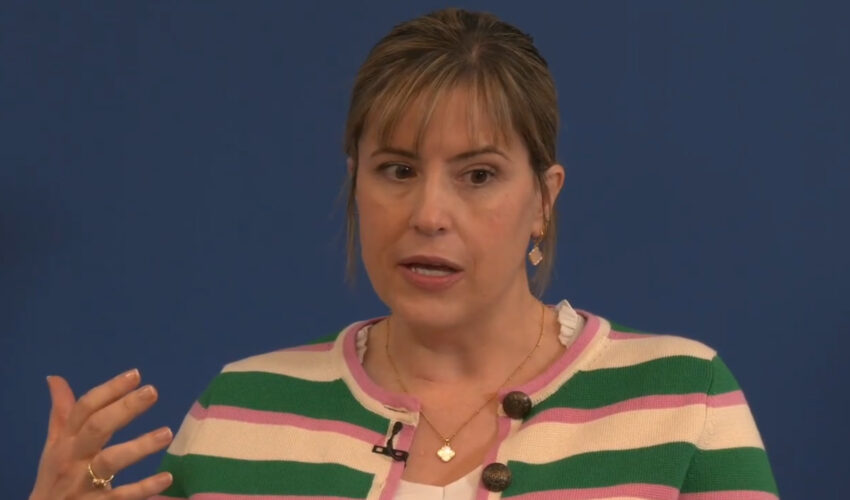

VAT Director Gillian McGill and Tax Partner Dominic Carter discuss the latest updates from HMRC focusing on corporation tax measures, transfer pricing, permanent establishment, diverted profits tax, payrolling benefits in kind, and the implications of changes to the capital goods scheme for VAT.

Corporate Tax Roadmap : Reflections on the Spring Budget

11 July 2025 5626 Views

Related Videos

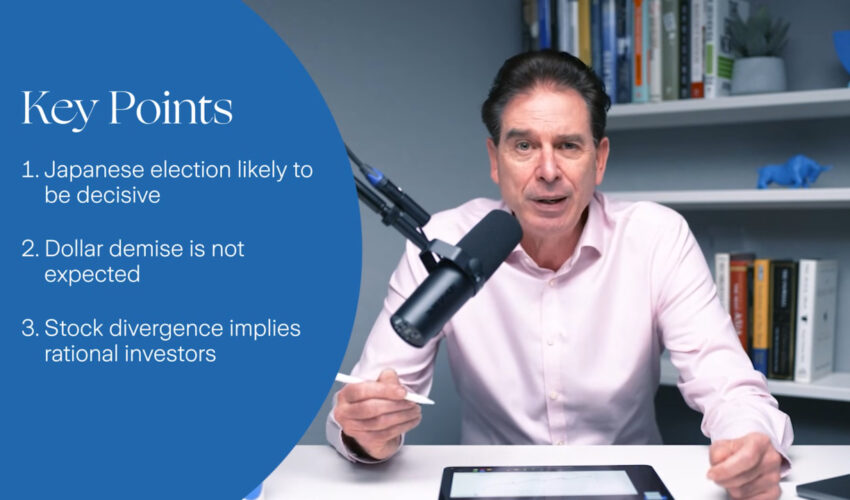

US dollar forecast 2026: Stable or stormy? | Monthly Investment Insights

Zurich Insurance Group11376 views 13 February 2026

US tariffs & European business: ING CEO Steven van Rijswijk at Davos 2026

ING7235 views 2 February 2026

Electric Vehicles: Managing the risks behind the charge

Zurich Insurance Group11677 views 27 January 2026

Intellectual Property to Drive Growth, Access Funding and Improve Resilience

BusinessTV34768 views 19 January 2026

Investment outlook – Handling the shifting investment landscape

BNP Paribas Asset Management10918 views 19 January 2026

USD 400 billion in tech investment: Is it really that much? | Monthly Investment Insights

Zurich Insurance Group8377 views 13 January 2026

Pensions dashboards webinar: Are you ready to connect?

The Pensions Regulator3708 views 16 December 2025

What does the AUTUMN BUDGET mean for you and your business?

TaxAssist Accountants4778 views 12 December 2025

Future-Proofing Your Wealth with Trusts and Family Investment Companies.

BusinessTV30450 views 9 December 2025

Cut National Insurance Contributions and Boost Pensions via Salary Sacrifice

BusinessTV12218 views 4 December 2025

Autumn Budget 2025: What it means for your family business

Moore Kingston Smith LLP12663 views 2 December 2025

Budget 2026 Ireland | R&D Tax Credit & Innovation Insights | EY Ireland

EY UK&I5291 views 24 November 2025

Turning point for the UK economy? Interest rate cuts edge closer

Fidelity UK12855 views 20 November 2025

Register of Overseas Entities: understanding UK property rules for overseas owners

Saffery7165 views 14 November 2025

Agricultural Property Relief: What should landowners be doing now?

Saffery3853 views 6 November 2025

Making Tax Digital for Income Tax – What you need to know

TaxAssist Accountants4783 views 29 October 2025

Search by Topics & Industries

The Rural Report Autumn Winter 2025/26

“Learn How To Say No” – Exporting Tips

Deleting data: what businesses need to know about data retention

What is the UK Export Academy?

The Pensions Regulator – Succeeding with automatic enrolment: Expert insights for advisers

Disputes Nightmares: What would you do if….a senior employee had stolen confidential information?

What comes first, vision or buy-in?

Selling Your Business > You’ll need the Right Team in Your Corner

Why Wealth Planning prior to a business sale?

Popular

Preparing for Green Reforms: Impact on the retail sector

Mishcon de Reya LLP129787 views 18 July 2024

UK Foodstores: 5 things you should know

Knight Frank119158 views 18 March 2024

Expert Exporting with the British Chambers of Commerce

BusinessTV76413 views 15 October 2023

Selling Your Business > You’ll need the Right Team in Your Corner

BusinessTV54406 views 11 October 2023

Short Dated Government Bonds : An attractive alternative to Cash Deposits

BusinessTV49650 views 5 November 2024

Grow your Pension, Buy Commercial Property, Invest in your Business.

BusinessTV46517 views 29 March 2025

Managing the Proceeds from Selling Your Business

BusinessTV43501 views 1 September 2023

AIM for IHT

BusinessTV40708 views 22 January 2024

Free Financial Guidance and Support for your Employees

BusinessTV40521 views 21 July 2024

Funding the Sale of Your Business to an Employee Ownership Trust

BusinessTV38946 views 22 October 2024

Salary Sacrifice for Pensions: Still a Powerful Tool But After the NI Changes Employers Need a New Game Plan

BusinessTV38663 views 12 January 2026

Intellectual Property to Drive Growth, Access Funding and Improve Resilience

BusinessTV34768 views 19 January 2026

Understanding Master Trusts with the Society of Pensions Professionals

BusinessTV34498 views 20 July 2023

Price Increase Management for B2B Companies

Simon-Kucher & Partners32093 views 15 March 2022

Tom Stevenson’s Q4 Investment Outlook

Fidelity UK31455 views 13 October 2022

Retailer pricing strategies

Simon-Kucher & Partners30662 views 31 August 2022

Future-Proofing Your Wealth with Trusts and Family Investment Companies.

BusinessTV30450 views 9 December 2025

ABL – Your Best Route to Raising Finance?

BusinessTV29434 views 11 November 2024

Planning for retirement – helping employees avoid pension-value destruction

BusinessTV28976 views 20 September 2023

Greenification of Transport Webinar – The future of clean mobility in Europe

Fieldfisher28669 views 17 August 2022

Search here

Latest Content

Taking Stock – After The Bell Podcast: Dog on a Lead

Quilter Cheviot8425 views 20 February 2026

Let’s talk antitrust | The Nissan Iberia case

Norton Rose Fulbright4299 views 20 February 2026

COO Network podcast – COOs as translators: Bridging the boardroom and the business

BaringaPartnersLLP8289 views 19 February 2026

BS EN ISO 14001:2026 Environmental Management Systems: What’s New?

British Standards Institution (BSI Group)6540 views 19 February 2026

The fundamentals of Customs & Duty

Azets UK12328 views 18 February 2026

Regulatory Initiatives Grid & Risk Transfer Market | Pensions in 10

Broadstone5288 views 18 February 2026

Why don’t UK investors like UK companies?

Fidelity UK11415 views 17 February 2026

CFAAR Panel Special – Global Warming or Another Crypto Winter?

Grant Thornton5171 views 17 February 2026

The creative strategies defining brand success in 2026

The Chartered Institute of Marketing6182 views 16 February 2026

Mastering VAT Recovery: Process, Pitfalls & Practicalities

Saffery10647 views 16 February 2026

US dollar forecast 2026: Stable or stormy? | Monthly Investment Insights

Zurich Insurance Group11376 views 13 February 2026

How to plan for the new tax year

Moore Kingston Smith LLP16437 views 13 February 2026

Transforming IT Operations in the Era of AI Agents

Gartner8579 views 12 February 2026

A landmark report to guide financial institutions through emerging legal and regulatory challenges

A&O Sherman12537 views 11 February 2026

Finance Leaders Barometer – Public Sector Results

Grant Thornton8310 views 11 February 2026

Is it time to reset supply chains?

Deloitte11169 views 10 February 2026

Employment Rights Act Webinar

Menzies6581 views 10 February 2026

Winter webinar: Unwrapping investment opportunities for 2026

Canaccord Wealth10698 views 9 February 2026

Clean Tech and AI

Withers & Rogers5978 views 9 February 2026

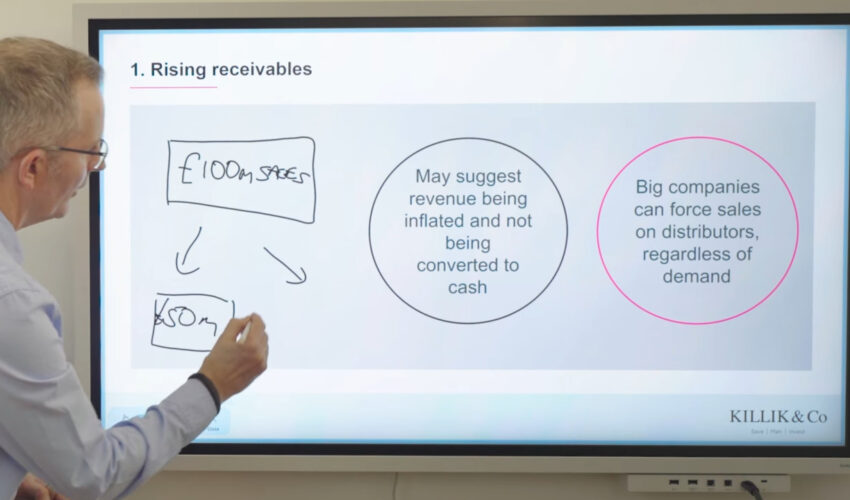

Six investing red flags (from the private credit world)

Killik & Co11582 views 9 February 2026

FT’s Jonathan Guthrie: this is the truth about investing

Fidelity UK15486 views 6 February 2026

Building foundations in a world chasing what’s next: HR People Pod – Ep 41

Chartered Institute of Personnel and Development6626 views 6 February 2026

Food & Agribusiness AM: Sustainability regulations – what food producers need to know

Mills & Reeve4895 views 5 February 2026

CharitEpulse: Diversity, disclosure and debt

Moore Kingston Smith LLP3303 views 5 February 2026

Let’s talk antitrust | Economic growth, UK merger control reforms

Norton Rose Fulbright9018 views 4 February 2026

HMRC enquiries: what to expect and how to prepare

Saffery11619 views 4 February 2026

EMEA Real Estate Outlook 2026

Jones Lang Lasalle11740 views 3 February 2026

Energy Innovators Podcast – S3 E3 – The future of long-distance clean power

BaringaPartnersLLP7018 views 3 February 2026

Investment Insights webinar: Predictions for 2026 – risks, opportunities and portfolio positioning

Rathbones8275 views 2 February 2026

US tariffs & European business: ING CEO Steven van Rijswijk at Davos 2026

ING7235 views 2 February 2026

Data Protection Day – championing privacy

Fieldfisher4696 views 2 February 2026

Reasserting UK leadership in financial and related professional services

PwC12928 views 30 January 2026

SPP Insights: Adequacy

The Society of Pension Professionals6295 views 30 January 2026

Gartner’s CEO Agenda for 2026: A Year of Wicked Messes

Gartner16388 views 29 January 2026

Adviser skills and the power of the life story

Legal & General4710 views 29 January 2026

Debt Restructuring Explained

Price Bailey10400 views 28 January 2026

Acas Webinar – Employment Rights Act 2025

ACAS3888 views 28 January 2026

How to Access Finance

HSBC11645 views 28 January 2026

Electric Vehicles: Managing the risks behind the charge

Zurich Insurance Group11677 views 27 January 2026

Pensions Bill, CDC Consultation, State Pension Taxation & Stagecoach Deal | Pensions in 10

Broadstone7105 views 27 January 2026

Outline Webinar: Changes of Use

DLA Piper4278 views 26 January 2026

How to strengthen your investing approach in 2026

Killik & Co6553 views 26 January 2026

Piers Linney and Carolyn Hicks talk Purpose v Profit | Alternatively Speaking

Grant Thornton10445 views 23 January 2026

The Herron Perspective: Conversations on leadership, culture and technology

Atos Group6242 views 23 January 2026

Ethical surveying during a housing crisis: RICS Harris Debate 2025

Royal Institution of Chartered Surveyors (RICS)3882 views 23 January 2026

How do we move AI from trialling to transforming? : The Green Room podcast, #95

Deloitte9718 views 22 January 2026

Understanding VAT and the impact to your business

Azets UK13600 views 22 January 2026

NEBOSH on the evolution of health and safety training

Make UK - The Manufacturers' Organisation7609 views 21 January 2026

What’s next for UK tech in 2026? Industry trends and insights

RSM UK16771 views 21 January 2026

UK FinReg Focus Areas in 2026

Latham & Watkins8224 views 21 January 2026

HR’s New Mandate: Redesign Work for the AI Era

Gartner14955 views 20 January 2026

Priorities for the People Profession in 2026: HR People Pod – Ep40:

Chartered Institute of Personnel and Development8341 views 20 January 2026

Intellectual Property to Drive Growth, Access Funding and Improve Resilience

BusinessTV34768 views 19 January 2026

Sales enablement reimagined — Where AI ends and humans begin | Mastering Sales and Negotiations

Huthwaite International8394 views 19 January 2026

Investment outlook – Handling the shifting investment landscape

BNP Paribas Asset Management10918 views 19 January 2026

The onward rise of antitrust litigation | Global antitrust and competition trends

Norton Rose Fulbright6195 views 16 January 2026

Nationwide: The Secret Sauce for Perfect Payments

Accenture UK3714 views 16 January 2026

Crowe Corner Risk Management

Crowe UK8926 views 15 January 2026

Regulatory Outlook January 2026

Osborne Clarke6746 views 14 January 2026

VAT registration for Partnerships – VAT Myths

Price Bailey3603 views 14 January 2026

Managing risk and recovery – your legal and commercial plan for cyber and supplier failures

Harper James6362 views 14 January 2026

USD 400 billion in tech investment: Is it really that much? | Monthly Investment Insights

Zurich Insurance Group8377 views 13 January 2026

Autumn Budget webinar 2025

Forvis Mazars7591 views 13 January 2026

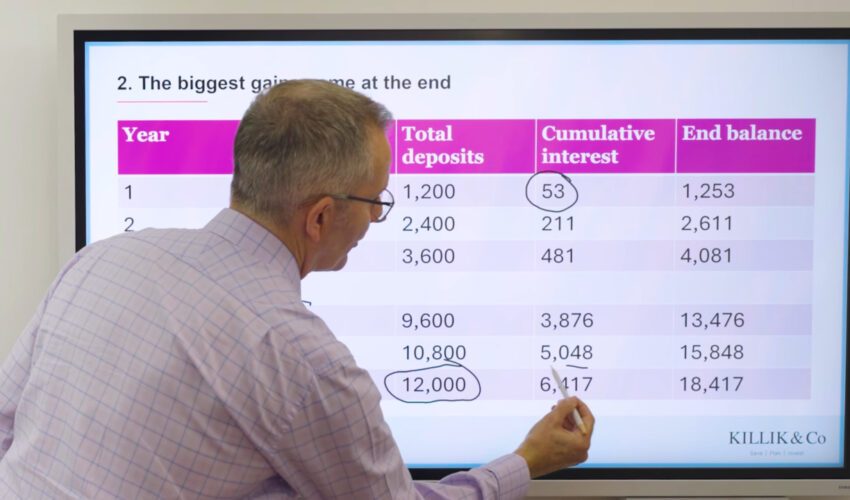

How to harness compound growth in 2026

Killik & Co10751 views 13 January 2026

Salary Sacrifice for Pensions: Still a Powerful Tool But After the NI Changes Employers Need a New Game Plan

BusinessTV38663 views 12 January 2026

Entertainment & Media: Building trust and accountability as AI becomes mainstream

PwC9426 views 12 January 2026

Education and Skills Policy Forum webinar

IOD2968 views 12 January 2026

Taking Stock after the Bell: What happened in 2025 and what lies ahead

Quilter Cheviot6933 views 12 January 2026

Using AI for financial crime detection and prevention

Grant Thornton2697 views 9 January 2026

The CBI Exchange: Beyond the Budget – Episode 3

CBI15671 views 9 January 2026

Reporting and disclosure under the new SORP

Saffery4939 views 9 January 2026

DB Scheme Return Changes & Budget | Pensions in 10

Broadstone3943 views 8 January 2026

2026 Tech Trends | Insights from Pascal Brier & Bernard Marr

Capgemini8597 views 8 January 2026

Power Up your communication

HSBC5819 views 7 January 2026

The Digital Omnibus package – what do you need to know?

Fieldfisher6448 views 7 January 2026

Rewriting the rules on workplace conflict – with David Liddle

Chartered Institute of Personnel and Development5252 views 7 January 2026

On Site Construction Webinar Series

WFW LLP3918 views 7 January 2026

Beyond AI Agents: The Future of Enterprise AI

Gartner4777 views 6 January 2026

Retail Rewired: From Trolleys to Tech

Accenture UK3980 views 6 January 2026

Trends in Tech M&A | Europe focused

Norton Rose Fulbright4686 views 5 January 2026

Are you prepared for FRS 102?

Moore Kingston Smith LLP2589 views 5 January 2026

Investment lessons for investors in 2026

Rathbones10331 views 5 January 2026

Andrew Kail and Gareth Mee reflect on a busy year in the pension risk transfer (PRT) market

Legal & General4171 views 23 December 2025

Why is the Bank of England worried about private credit?

Killik & Co2896 views 23 December 2025

Let’s talk antitrust | Anti-competitive disparagement: What is this?

Norton Rose Fulbright2193 views 22 December 2025

What will it take to power our AI goals?

Deloitte8649 views 22 December 2025

Spotlight on Wealth Trends – The Influences Shaping Global Real Estate

Savills5400 views 19 December 2025

Decarbonising complex industries

BaringaPartnersLLP3619 views 18 December 2025

An update on Making Tax Digital

Azets UK6800 views 18 December 2025

Preventing economic crime – what really works?

Grant Thornton3143 views 17 December 2025

Pensions dashboards webinar: Are you ready to connect?

The Pensions Regulator3708 views 16 December 2025

Succession in financial advice: Apprenticeships and the next generation

Legal & General5798 views 16 December 2025

Cash ISA overhaul: what can savers do now?

Fidelity UK10631 views 16 December 2025

Why should pension schemes care about nature related risk?

Gowling WLG4982 views 15 December 2025

The 4 Biggest Challenges for IT Leaders in 2026

Gartner11868 views 15 December 2025

Outline webinar: Compulsory Purchase – Will changes boost growth?

DLA Piper6683 views 15 December 2025

What does the AUTUMN BUDGET mean for you and your business?

TaxAssist Accountants4778 views 12 December 2025

SPP Insights: Superfunds

The Society of Pension Professionals9437 views 12 December 2025

Taking Stock after the Bell: Not Another Budget Podcast!

Quilter Cheviot8369 views 11 December 2025

Carbon credits explained with Nature Broking and UY

UHY Hacker Young10764 views 11 December 2025

Alternatively Speaking – Political Promises v Business Reality – Episode 1

Grant Thornton8200 views 10 December 2025

Driving Change and Unlocking Career Development through Standards

British Standards Institution (BSI Group)3997 views 10 December 2025

Mainframe Modernization – Episode 2 – Patterns & Pathways: Choosing the Right Modernization Approach

Atos Group6288 views 10 December 2025

Future-Proofing Your Wealth with Trusts and Family Investment Companies.

BusinessTV30450 views 9 December 2025

Wilful misconduct and deliberate breach | Outsourcing and transitional services agreements

Norton Rose Fulbright7077 views 8 December 2025

What does the Autumn Budget mean for your personal finances?

Charles Stanley5854 views 8 December 2025

Market Update Q4 2025

Gardiner & Theobald11855 views 5 December 2025

Duncan & Toplis On Air – Autumn Budget 2025 Reaction

Duncan Toplis8471 views 5 December 2025

Forecasting the food industry in 2026: Health, environment, security and regulation

Mills & Reeve4654 views 5 December 2025

Budget tax rises – here’s where they hit the hardest

Fidelity UK12267 views 4 December 2025

Cut National Insurance Contributions and Boost Pensions via Salary Sacrifice

BusinessTV12218 views 4 December 2025

Europe’s Recession Risk: ING CEO on what comes next and why it matters now

ING12764 views 3 December 2025

The future of marketing in 2026: AI takes over

The Chartered Institute of Marketing12855 views 3 December 2025

What does the 2025 budget mean for you?

Brooks Macdonald8368 views 3 December 2025

FS in Focus: Post-trade modernisation in banking

BaringaPartnersLLP4536 views 3 December 2025

Autumn Budget 2025: Business Tax

Carpenter Box10664 views 3 December 2025

Autumn Budget 2025: What it means for your family business

Moore Kingston Smith LLP12663 views 2 December 2025

CBI Autumn Budget 2025 member webinar

CBI11602 views 2 December 2025

Autumn Budget 2025 webinar

Rathbones16342 views 1 December 2025

Mainframe Modernization podcast – Episode 1 – From COBOL to Cloud. Why modernize now?

Atos Group4789 views 1 December 2025

Perspectives: The investment landscape in 2026 – with Legal & General

HSBC10794 views 28 November 2025

Autumn Budget 2025: Caroline Fleet responds

Crowe UK9724 views 28 November 2025

Dispute resolution: Early advice can reduce long-term expenses

Grant Thornton4791 views 27 November 2025

What could threaten the AI shares boom?

Killik & Co6648 views 27 November 2025

Overcoming the leadership challenges in large and complex transformations.

PA Consulting3171 views 27 November 2025

Indemnification | What does an indemnity cover?

Norton Rose Fulbright4759 views 26 November 2025

ASEAN Special Interest Group Podcast | Vietnam-UK Trade Under CPTPP

IOD6411 views 25 November 2025

Elevate employee experience without hurting the bottom line

Moore Kingston Smith LLP10691 views 24 November 2025

Budget 2026 Ireland | R&D Tax Credit & Innovation Insights | EY Ireland

EY UK&I5291 views 24 November 2025

Techceleration – The Key to Digital Transformation

Capgemini6469 views 21 November 2025

Investment Insights Webinar – Q4 2025

Rathbones7504 views 21 November 2025

What has been happening in the food and agriculture sector?

BNP Paribas Asset Management2627 views 20 November 2025

Impact of US trade policies on UK companies

Price Bailey11029 views 20 November 2025

Turning point for the UK economy? Interest rate cuts edge closer

Fidelity UK12855 views 20 November 2025

Entertainment & Media: Trends transforming the UK industry

PwC7494 views 19 November 2025

Decoding AI and the future of Technology: Taking Stock after the Bell

Quilter Cheviot6840 views 19 November 2025

The CBI Exchange: The Budget Briefing – Episode 1

CBI6022 views 18 November 2025

Meta’s CMO on AI, creativity, and what’s next for digital marketing

The Chartered Institute of Marketing8680 views 18 November 2025

Pension Consolidation: What it is and how it works

Legal & General11983 views 17 November 2025

Autumn Budget Predictions 2025

Forvis Mazars14911 views 17 November 2025

Three key numbers for bond investors

Killik & Co9002 views 14 November 2025

Register of Overseas Entities: understanding UK property rules for overseas owners

Saffery7165 views 14 November 2025

Cyber Security in UK Manufacturing: Hidden Risks, Human Error & How to Stay Protected

Make UK - The Manufacturers' Organisation9737 views 13 November 2025

The EU Data Act: A Digital Game-Changer

Latham & Watkins6456 views 13 November 2025

The Year of AI Value: Beyond the Hype Cycle

Gartner8550 views 12 November 2025

Understanding Innovation Reliefs

Azets UK15305 views 12 November 2025

Global Insurance Marketplace Insights Q3 2025 – Europe

Willis Towers Watson7850 views 12 November 2025

How SMEs can unlock growth with Richard Bearman from the British Business Bank

MHA UK9466 views 11 November 2025

UK Consumer Spending outlook – Q4

BaringaPartnersLLP11445 views 10 November 2025

Taking pension tax-free cash? Don’t make these mistakes

Fidelity UK12898 views 7 November 2025

Employment Rights Bill | AI performance reviews

Chartered Institute of Personnel and Development3999 views 7 November 2025

Rabobank x DLA Piper on AI

DLA Piper5889 views 6 November 2025

Agricultural Property Relief: What should landowners be doing now?

Saffery3853 views 6 November 2025

Should you take your tax-free lump sum before the Budget?

Hargreaves Lansdown12127 views 5 November 2025

Digital crime, sanctions and strategy

Grant Thornton6408 views 5 November 2025

Spotlight on the Global Trade Landscape

HSBC15180 views 4 November 2025

The Glastonbury of Pensions, ICO Cyber Fine & Sterling 20

Broadstone6932 views 4 November 2025

Why you need to embrace twofaced strategies in the new era buying

Huthwaite International12876 views 3 November 2025

Singapore-UK Trade Under CPTPP : ASEAN Special Interest Group Podcast

IOD8434 views 3 November 2025

The case for diversification | Investment Update, November 2025

Rathbones12611 views 31 October 2025

How to decode consumer behaviour

The Chartered Institute of Marketing8949 views 31 October 2025

TCPA lessons learned and NSIP predictions

DLA Piper4129 views 30 October 2025

Inflation joy: good news for pensioners and borrowers

AJ Bell6071 views 30 October 2025

What is the Laffer curve and why is it in the news?

Killik & Co11111 views 29 October 2025

Making Tax Digital for Income Tax – What you need to know

TaxAssist Accountants4783 views 29 October 2025

‘Write it, or refer it’: Growth through pioneering protection approaches

Legal & General6497 views 28 October 2025

Transfer pricing methods

Price Bailey9721 views 28 October 2025

Will Tokenized Equity Transform Capital Markets? : LathamTECH in Focus:

Latham & Watkins5088 views 27 October 2025

Unpacking the FCA’s proposed motor finance redress scheme: What you need to know

Grant Thornton8005 views 27 October 2025

Strengthening Business Resilience: Part 1

Azets UK14887 views 24 October 2025

Taking Stock after the Bell: Bubble Watch

Quilter Cheviot9488 views 24 October 2025

What’s next for media M&A in 2026?

Moore Kingston Smith LLP5873 views 24 October 2025

New Superfund & Taxing Mctaxface | Pensions in 10

Broadstone5362 views 23 October 2025

Copyright in the age of AI: Who owns what?

Harper James7078 views 23 October 2025

Pre Autumn Budget 2025 webinar: Preparing for any changes

Canaccord Wealth14659 views 23 October 2025

Marketing’s Epic Journey: Readiness, Reputation & Resilience

Gartner12131 views 22 October 2025

What if our next decision makers aren’t human?

Deloitte13187 views 22 October 2025

AI bubble? Tax rises? Six answers investors need now

Fidelity UK8519 views 21 October 2025

Investigations and personal data – what you need to know : In-house in Focus webinar

Mills & Reeve4131 views 21 October 2025

Environmental hot topics explained

Make UK - The Manufacturers' Organisation8524 views 20 October 2025