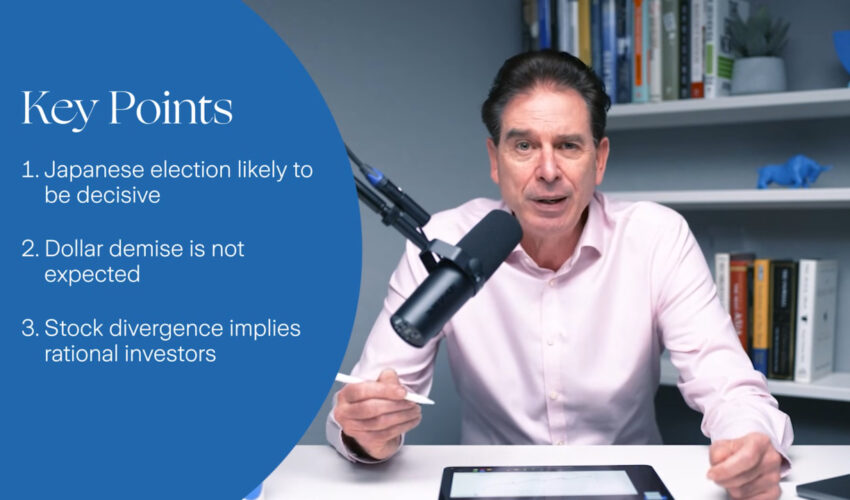

If you’re currently seeking finance – perhaps to finance an acquisition or simply to have enough working capital to fulfill some large orders – then you’ll want to consider Asset Based Lending, (ABL). In this Interview Mark Parsons of Shawbrook takes us through the many benefits of ABL and explains why it frequently out performs traditional, less flexible forms of finance that a business may arrange with their bank. Mark and his team are very proud of the enviable reputation they’ve built as a helpful lender to the Mid Market who make every effort to foster real working relationships between themselves and their clients.

Watch some short extracts of our Interview with Mark Parsons

Watch the full Interview here

Learn more about Mark, Shawbrook and Asset Based Lending below

Mark Parsons

Head of Asset Based Lending and Managing Director, Corporate Lending – Midlands, North & Scotland

With over 25 years’ experience in the corporate banking sector, Mark’s experience encompasses a broad range of business finance facilities including Asset Based Lending, Cashflow Lending, & Asset Finance. His aim is to support SMEs and Mid-Market businesses with great lending solutions that address simple to complex requirements and enable them to achieve their business ambitions and goals.

Mark joined Shawbrook nearly 6.5 years ago with his role focusing on Asset Based Lending and non-sponsor Cashflow Lending to assist businesses with Management Buy-outs, Mergers and Acquisitions, Growth Funding, Exits for Private Equity and EOT’s. This and further senior roles at Shawbrook provided the opportunity and further grow the experience Mark had in working with introducers, accountants and legal groups to support businesses across a variety of sectors including manufacturing, automotive, packaging etc.

Mark’s expertise in the industry made him the ideal candidate to head up the ABL team at Shawbrook and alongside this, Mark manages a 10-strong Corporate Lending team in the Midlands, North and Scotland regions.

Specialties: Leadership, Origination, Corporate Lending, Asset Based Lending, Cashflow Lending, Leverage Finance, Acquisition, Restructure and Exit Finance, Alternative Lending, Employee Ownership Trusts.

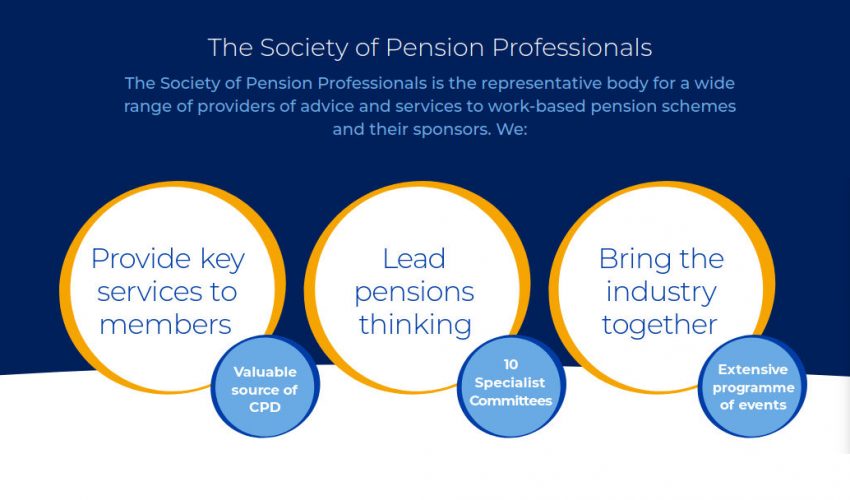

Asset Based Lending

For businesses with substantial value tied-up in both hard and paper assets, our Asset Based Lending proposition can unlock that value to provide both immediate cash and on-going financial headroom to support pivotal events.

A covenant-lite and flexible funding solution designed around the specific characteristics and needs of each client, an ABL structure can provide certainty and puts the customer in control – only drawing funds when required.

- Facilities from £1m – £35m

- Multi-asset revolving working capital facilities which can include Receivables, Inventory Finance, and a combination of other assets

- We also offer multiple option term debt funding solutions that can include combinations of Property Finance, Plant and Machinery Finance, and Cashflow, in amortising and interest-only structures

- Security: senior all asset debenture. Parental and cross guarantees may also be required

Asset Based Lending Case Study 1:

Supporting Distinction Doors with a working capital solution to include

invoice discounting and an inventory and cash flow facility

Yorkshire door business secures multimillion pound support from Shawbrook

Distinction Doors is the largest composite door manufacturer in the UK.

It required funding to increase its inventory and accelerate its capital expenditure.

Learn how we tailored a working capital solution to include invoice discounting and an inventory and cash flow facility, meaning Distinction Doors has been able to invest in new machinery and focus on its sustainability journey.

Asset Based Lending Case Study 2:

Genius Foods, who specialise in manufacturing gluten free baked goods

have been provided with an Asset Based Loan (ABL) worth £7.5 million.

At a glance

Genius Foods is set to improve efficiencies and increase production at its Scottish based bakery.

The gluten free manufacturer also re-financed its existing funding lines, following its acquisition by Katjes Group.

Shawbrook provided a £7.5m Asset Based Loan to support the business with their growth plans

Asset Based Loan (ABL) worth £7.5 million

Genius Foods, who specialise in manufacturing gluten free baked goods across the UK, Europe and Australia, have been provided with an Asset Based Loan (ABL) worth £7.5 million by Shawbrook. The full terms of the package include a £5 million invoice-financing line, a £1.5 million property loan and a £1 million cashflow loan over a 3-year term.

The two parties struck the deal as Genius Foods (Genius) was looking to re-finance an existing invoice finance line and raise additional funds to improve efficiency and production lines in its bakery based in Bathgate, Scotland. The agreement was reached in the wake of Genius’ acquisition by Germany- based confectionary business, Katjes Group last year.